Wearables have come a long way from counting steps and flashing notifications.

The stuff hitting the market now? It's detecting heart conditions before you feel symptoms. It's tracking your fertility cycle with clinical accuracy. It's literally replacing your wallet, your glasses, and — if you listen to the hype — maybe even your phone someday.

But I'm not here to hype you. I'm here to show you what's actually happening, backed by hard numbers from IDC, Counterpoint Research, the FDA, and other organizations that track this stuff for a living.

Top Wearable Technology trends going into 2026:

- Smart rings go mainstream — 49% shipment growth, Oura holds 80% market share

- Smart glasses explode — 110% YoY growth, Meta captures 73% of market

- Clinical-grade health monitoring arrives — WHOOP, Biolinq get FDA clearances

- Sleep tracking becomes essential — $20.8B market by 2035, 72% via wearables

- AI moves to your wrist — On-device health predictions, $169B market by 2029

- Earbuds become health devices — 84.9M units shipped, now with heart rate sensors

- Femtech wearables surge — $235.6B fertility tracking market by 2032

Let's get into it.

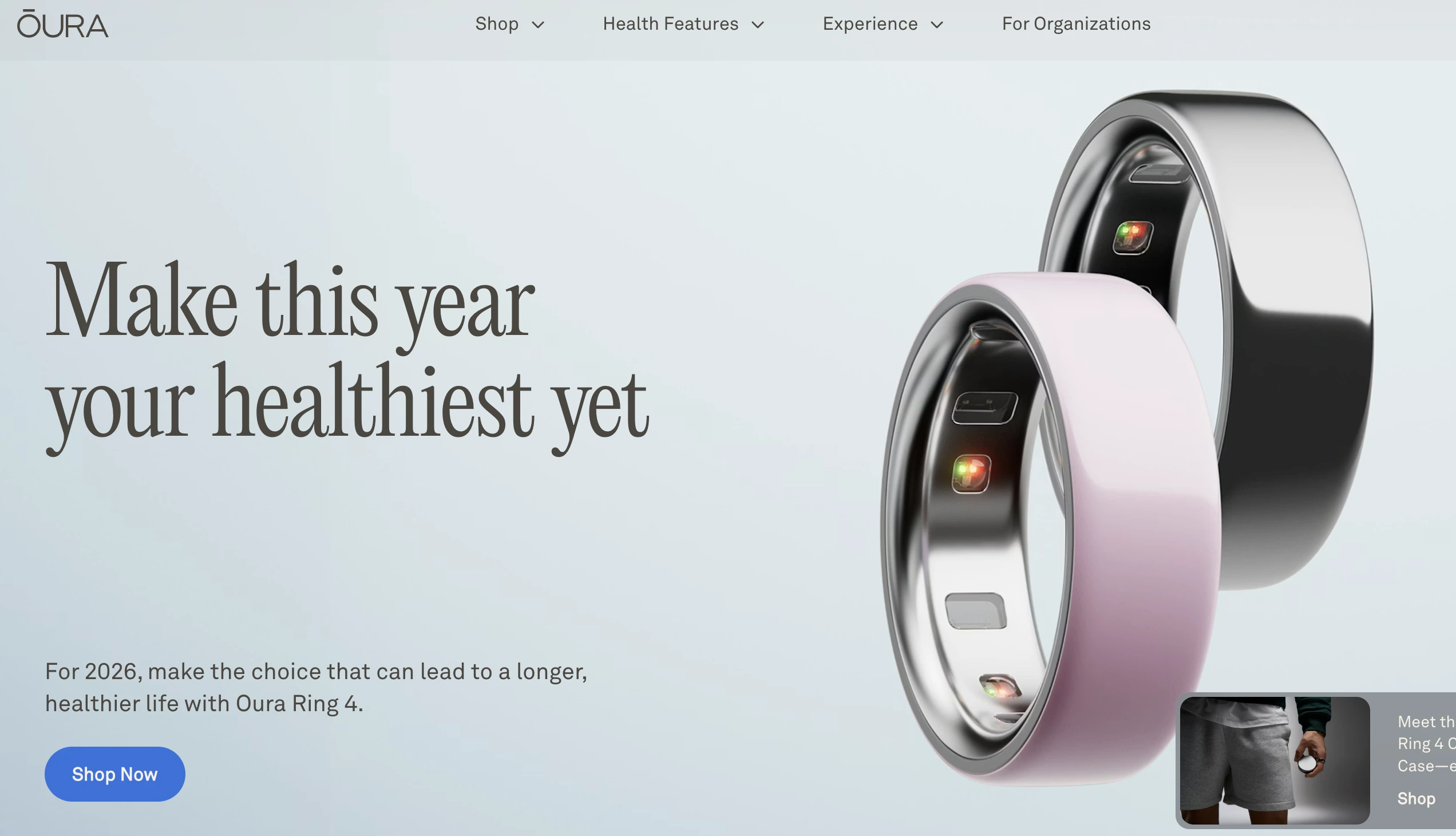

1. Smart Rings Are Having Their Moment

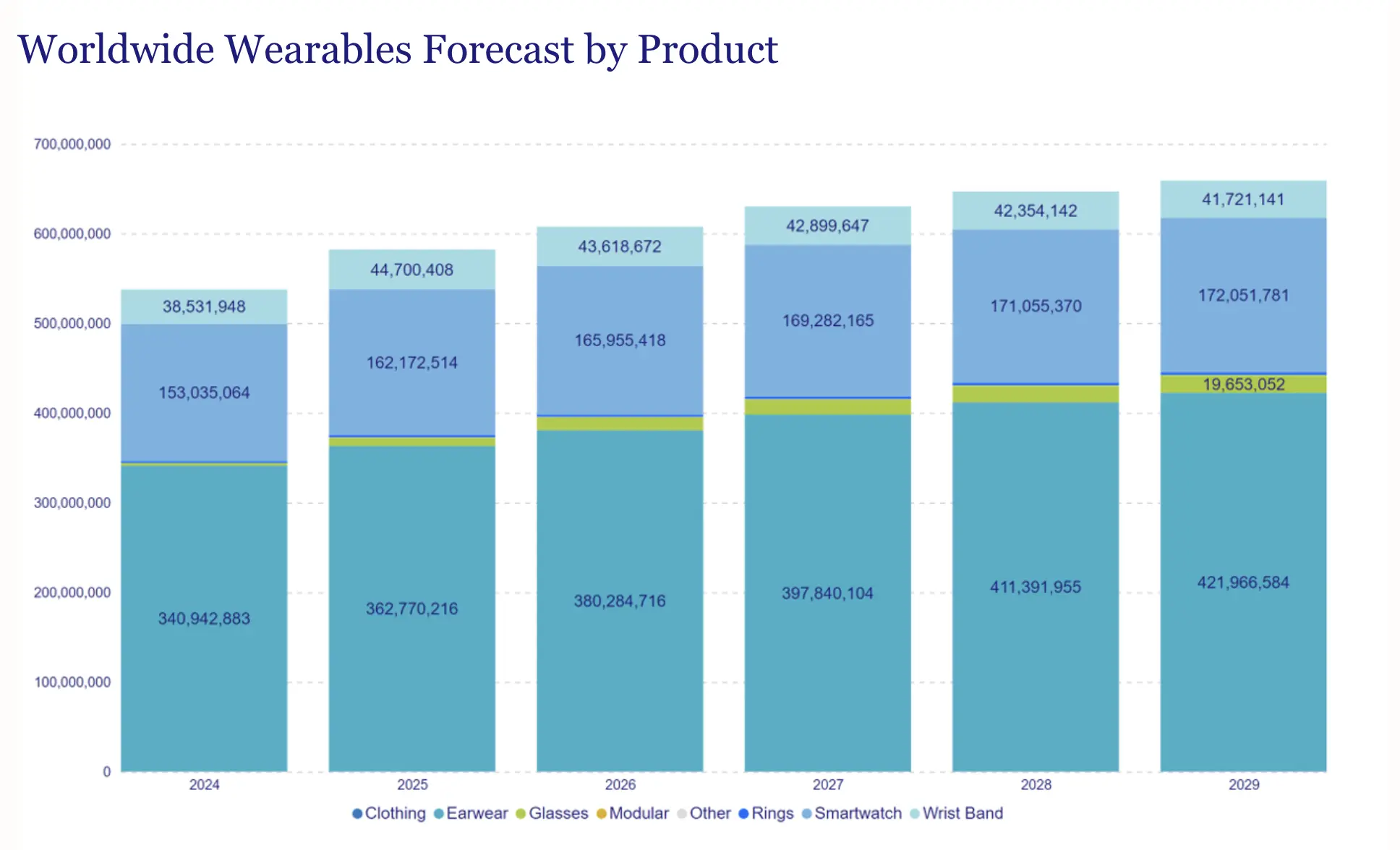

Here's the number that caught my attention: according to IDC's analysis, smart ring shipments are on track for a 49% jump in 2025 — while smartwatches grew just 6%. That's not a rounding error. That's a category taking off.

The raw numbers are still small — 4.3 million smart rings shipped versus 163 million smartwatches — but the growth trajectory is wild. According to Circana's retail tracking data, U.S. smart ring revenue hit $217 million year-to-date in 2025, with unit volume up 195% versus a year ago. Smart rings now account for 75% of total fitness tracker revenue, up from just 46% a year ago.

And then there's the market projections: Fortune Business Insights estimates the smart ring market will grow from $378 million in 2026 to $3.1 billion by 2035 — a 26.4% CAGR.

What's happening in the real world

Oura dominates with roughly 80% of global smart ring sales. In December 2024, they raised $200 million at a $5.2 billion valuation to invest in AI-powered features. Even more interesting: Oura partnered with the Naval Health Research Center, the Air Force, and the Defense Innovation Unit to put smart rings on service members' fingers — a clear signal that the military sees value in continuous health monitoring.

Samsung entered the ring game with the Galaxy Ring in 2024, and they're playing a different angle — no subscription required. While Oura charges monthly for full features, Samsung bundles everything with the hardware. That's going to force some interesting pricing decisions across the industry.

CES 2026 was flooded with smart ring announcements. According to CES Tech's official coverage, smart rings were "no longer a side attraction" — Oura, Ultrahuman, RingConn, and others were headline exhibitors. Every hardware company sees the wave coming.

Where this is heading

2026 is the year smart rings go from "tech enthusiast curiosity" to "legitimate category." The form factor just makes sense for sleep tracking — nobody wants to wear a chunky watch to bed. And as the sensors get better (heart rate variability, blood oxygen, temperature), rings will handle most of what smartwatches do, minus the screen.

The real question is whether Oura can maintain its 80% grip as Samsung scales up and Chinese manufacturers flood the market with $50 alternatives. My bet: the premium market stays with Oura, but the mass market gets very competitive very fast.

2. Smart Glasses Are Exploding — And Meta Is Running Away With It

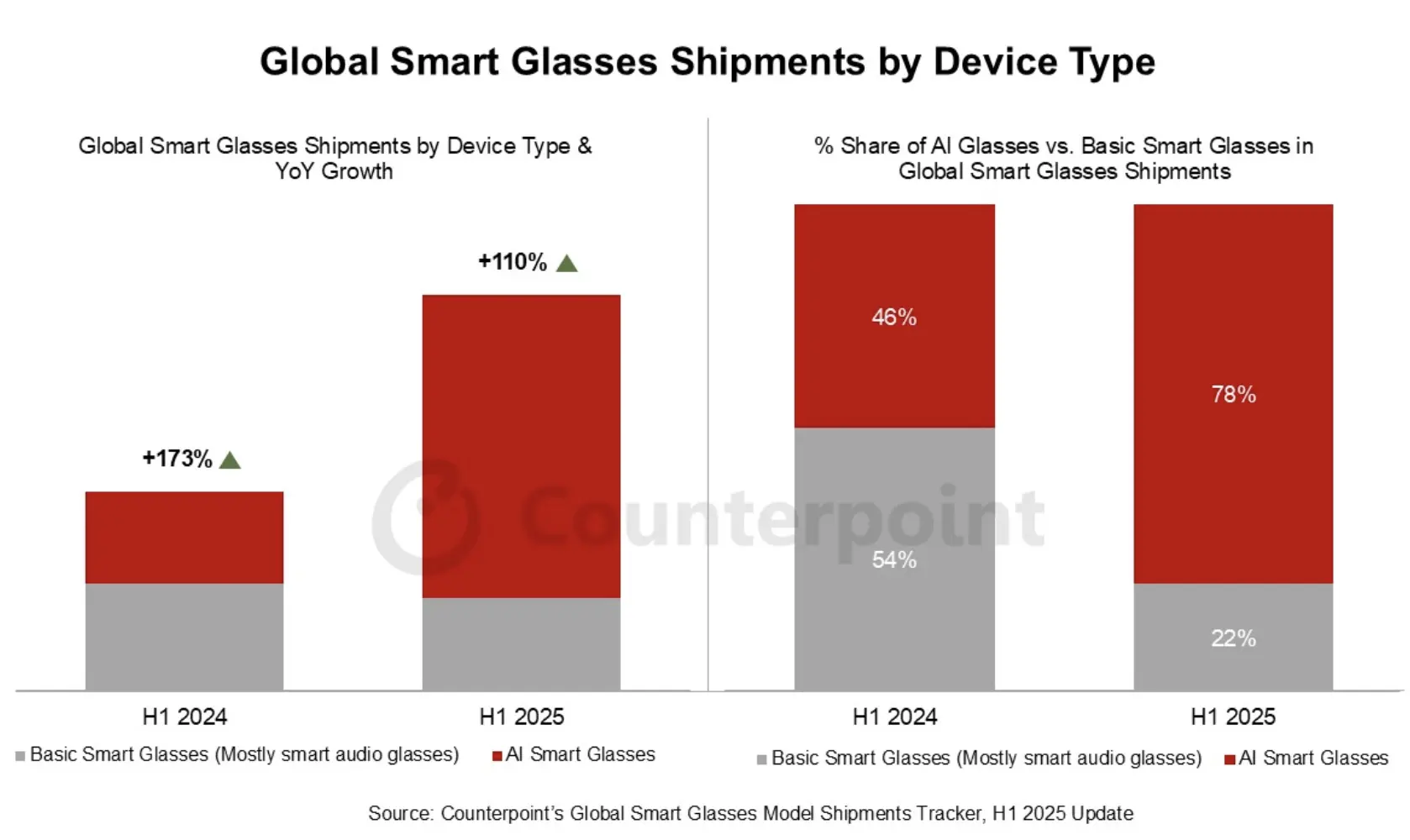

The numbers here are genuinely surprising. According to Counterpoint Research, global smart glasses shipments grew 110% year-over-year in H1 2025. Not 10%. Not even 50%. One hundred and ten percent.

And it's basically all Meta. Their share of the global smart glasses market hit 73% in H1 2025. IDC reports that the smart glasses category specifically is growing 247.5% during the year.

The Ray-Ban Meta Smart Glasses have been the driver. Year-over-year sales grew by over 300% according to the same Counterpoint data. Meta has sold over 2 million units since the October 2023 launch, with revenue tripling versus 2024.

Here's what really tells the story: AI glasses now account for 78% of total smart glasses shipments, up from 46% in H1 2024. Consumers aren't buying basic camera glasses — they want the AI assistant built in.

What's happening in the real world

Meta launched their display-equipped Ray-Ban glasses in September 2025 at $799, and they sold out within 48 hours. The company faced "unprecedented" demand and had to delay wider rollout. When your $800 glasses sell out in two days, you've hit something.

Google isn't sitting still. They've partnered with Warby Parker to expand style options — essentially lowering the fashion barrier that killed Google Glass the first time around.

Xiaomi and TCL-RayNeo have entered the market, driving competition in Asia Pacific. China contributed 494,000 units in Q1 2025 alone — a 116.1% increase year-over-year.

The geographic expansion is accelerating too. In Q2 2025, Meta and Luxottica expanded Ray-Ban Meta glasses to India, Mexico, and the UAE.

Where this is heading

2026 is when we find out if smart glasses are a real product category or just a Meta thing. The display-equipped models change the game — instead of just listening to an AI, you'll see translations, navigation, and notifications overlaid on your view.

The fashion problem that killed Google Glass? Largely solved. Ray-Bans look like... Ray-Bans. The price problem? $299 for the non-display version is accessible. The use case problem? AI assistants finally make the "why would I want this?" question answerable.

Expect Apple to enter this market within 18-24 months. When they do, it'll validate the category the same way AirPods validated wireless earbuds.

3. Wearables Are Getting FDA Clearances — And That Changes Everything

2025 was the year consumer wearables started getting serious regulatory approval. We're entering "Wearables 2.0" — the era of clinical-grade medical devices that look like consumer products.

In April 2025, WHOOP obtained FDA 510(k) clearance for its ECG feature, moving what was a pure fitness device into medical territory. The same month, Dexcom announced FDA clearance for the G7 15-Day CGM System with an improved accuracy of 8.0% MARD — the longest-lasting and most accurate CGM available.

September 2025 saw Biolinq receive FDA De Novo Classification for their Biolinq Shine — a forearm patch that tracks glucose, activity, and sleep for non-insulin type 2 diabetes patients. It's the first fully autonomous, needle-free glucose sensor.

But here's an important reality check: the FDA explicitly warns that you should NOT use smartwatches or smart rings to measure blood glucose. None are currently authorized, and using them for medical decisions "could result in serious injury or death."

![]()

What's happening in the real world

Apple Watch set the template years ago with FDA-cleared ECG and atrial fibrillation detection. According to research in Circulation Research, that clearance "set a precedent for other consumer-tech companies adding medical features."

VitalConnect's VitalRhythm biosensor was cleared for continuous ECG, heart rate, and respiratory monitoring — but it's a dedicated medical patch, not a consumer smartwatch. This points to an emerging split: consumer devices with some FDA-cleared features versus purpose-built medical wearables.

Continuous Glucose Monitors like Dexcom G7 and Abbott FreeStyle Libre 3 have hit clinical-grade accuracy — within ±9% of lab blood glucose tests. That's real medical device territory.

The convergence is happening from both directions: consumer wearables are adding medical features, while medical devices are getting sleeker designs.

Where this is heading

2026 is when the line between "wellness device" and "medical device" gets properly blurry. Blood pressure monitoring via Apple Watch is reportedly coming. More ECG clearances are expected. The continuous glucose monitoring market is pushing toward non-invasive options.

But regulatory approval takes time. The devices you'll buy in 2026 are already in FDA review now. The truly game-changing stuff — non-invasive glucose, continuous blood pressure, early disease detection — is still 2-3 years out for most consumers.

The big unlock? Insurance coverage. Once wearables have FDA clearance, the argument for insurance reimbursement gets a lot stronger. That's when adoption really explodes.

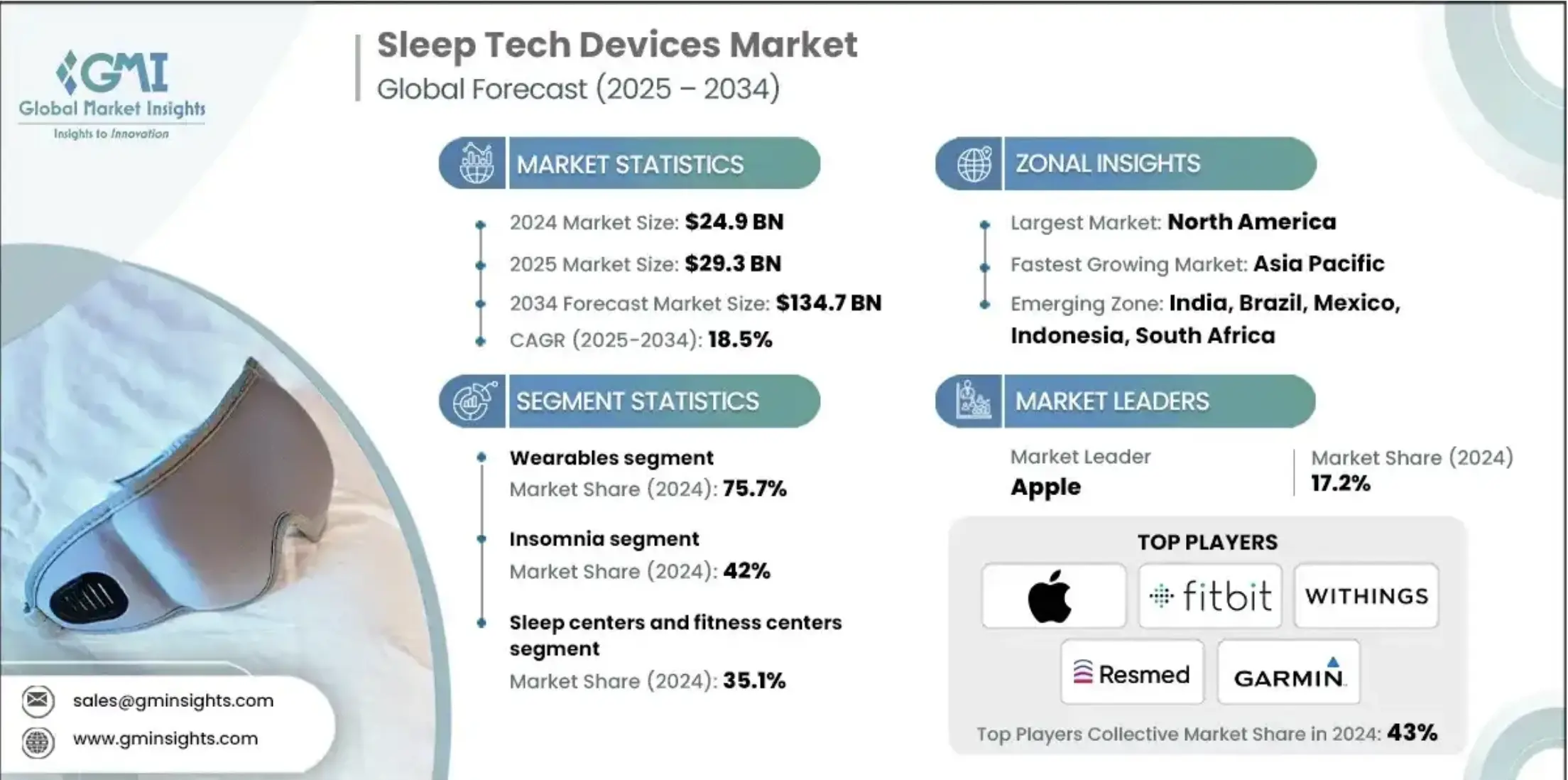

4. Sleep Tracking Is Becoming a $20 Billion Industry

Sleep tech is having a moment. According to Future Market Insights, the sleep tracking and optimization products market will grow from $3.6 billion in 2025 to $20.8 billion by 2035 — a 19% CAGR.

Here's what's driving it: wearable devices now account for 72% of the sleep tracking market in 2025. People want continuous, passive tracking — not a bedside device they have to remember to turn on.

The broader sleep tech devices market tells an even bigger story: projected to grow from $29.3 billion in 2025 to $134.7 billion by 2034. That includes everything from smart mattresses to white noise machines, but wearables are the fastest-growing segment.

According to Grand View Research, wrist and hand band devices hold 38.9% of market revenue in 2025, with watches leading overall due to their multifunctionality.

What's happening in the real world

Oura built their entire brand around sleep. Their "readiness score" — which synthesizes sleep data, HRV, and recovery metrics — has become the gold standard for how consumers think about sleep quality. The ring form factor is perfect for overnight wear.

WHOOP targets the performance crowd with detailed sleep stage analysis and strain metrics. Their subscription model ($30/month) bundles the hardware free, betting that ongoing data insights are more valuable than one-time device sales. (For more on how fitness tracking is reshaping training, see our fitness trends for 2026. And for how wearables are transforming healthcare for aging populations specifically, see our senior care trends for 2026.)

Apple acquired Beddit and has been building sleep tracking into the Apple Watch, though battery life remains a challenge. The recent Apple Watch Ultra addresses this somewhat with multi-day battery.

Eight Sleep represents the "smart mattress" approach — their Pod covers use temperature regulation and biometric tracking to optimize sleep. They've raised over $150 million and count professional athletes among their user base.

Where this is heading

2026 sleep tracking gets smarter, not just more data. The raw metrics — sleep stages, HRV, respiratory rate — are table stakes now. The differentiation is in actionable insights: when should you go to bed? When should you skip that morning workout because your recovery is tanked? (For the full breakdown of what's driving the sleep economy, see our sleep trends for 2026.)

AI coaching is the next frontier. Instead of just showing you that your sleep was bad, devices will tell you why and what to do about it. Expect personalized recommendations based on your patterns, not generic "get 8 hours" advice.

The integration play is also interesting. Sleep data combined with activity data, nutrition data, and stress data creates a much fuller picture of health than any single metric alone.

5. AI Is Moving Onto Your Wrist

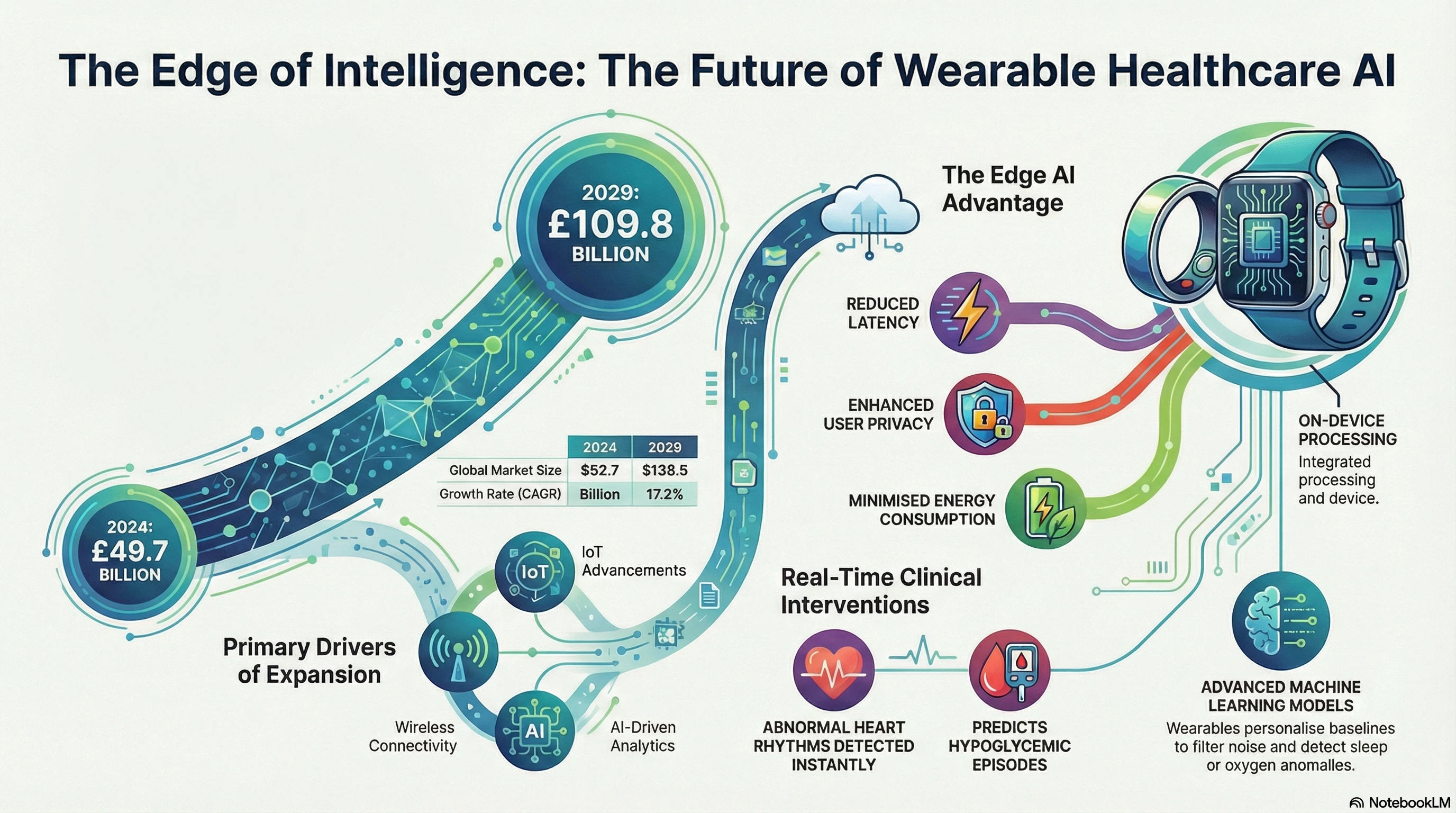

On-device AI is transforming wearables from data collectors into actual health advisors. According to MarketsandMarkets, the global wearable AI market is projected to grow from $62.7 billion in 2024 to $138.5 billion by 2029 — a 17.2% CAGR fueled by advancements in IoT, wireless connectivity, and AI-driven analytics.

The shift is from cloud-based processing to edge computing — AI that runs directly on the device. Research published in MDPI explains why this matters: "real-time analytics directly on the device, reducing latency, enhancing privacy, and minimizing energy consumption."

What does that look like in practice? Devices that can alert you to abnormal heart rhythms immediately. Continuous glucose monitors that predict hypoglycemic episodes before they happen. Wearables that detect stress and suggest interventions in the moment.

According to Springer research, machine learning models running on wearables now "filter noise, personalize baselines, and detect anomalies related to heart rhythm, blood oxygen, stress, and sleep."

What's happening in the real world

Apple has been building the neural engine into Apple Watch for years, enabling on-device processing of health algorithms. Their fall detection and crash detection features use AI to distinguish between actual emergencies and false positives.

Samsung unveiled the Galaxy Watch Ultra Sports Edition in January 2025 with multi-sport tracking and recovery algorithms developed with academic researchers. The AI doesn't just track your workout — it tells you when you're overtraining.

Oura's latest rings integrate what they call "AI-powered illness prediction" — analyzing patterns in temperature, HRV, and sleep to flag when you might be getting sick before you feel symptoms.

WHOOP uses AI to generate personalized strain recommendations. Instead of "get 10,000 steps," it tells you how much exertion your body can handle today based on your recovery state.

The broader trend, according to academic research, is AI that can "predict the risk of heart attacks by analyzing trends in heart rate, blood pressure, and activity levels."

Where this is heading

2026 is when AI wearables get genuinely predictive, not just reactive. The current generation tells you what happened — you slept poorly, your heart rate was elevated, your HRV dropped. The next generation tells you what's coming and what to do about it.

The integration with large language models is particularly interesting. Imagine asking your watch "Why did I sleep badly last night?" and getting an actual answer that considers your activity, stress levels, late caffeine, and bedroom temperature — not just a generic FAQ response.

Privacy is the tension point. On-device AI solves some concerns by keeping data local, but the most powerful models still need cloud processing. Expect this to be a major differentiator: companies that can deliver sophisticated AI insights without shipping your health data to servers will win trust.

6. Your Earbuds Want to Be Health Devices

Earbuds are the sleeper hit of health wearables. According to IDC's Wearable Devices Tracker, 84.9 million earwear units shipped in Q2 2025 — that's over 60% of total wearable shipments. More than smartwatches. More than fitness bands. More than everything else combined.

And they're not just for music anymore. The hearables market is projected to grow at an 11.7% CAGR through 2030, driven heavily by health feature integration. Deep Market Insights puts the market at $51.6 billion in 2025, growing to $97.3 billion by 2030.

The integration of health sensors is accelerating. The integration of sensors for heart rate, SpO2, and activity tracking is blurring the line between audio accessories and health-monitoring wearables.

What's happening in the real world

Samsung released Galaxy Buds in January 2025 with integrated health sensors capable of heart rate and stress monitoring. Your earbuds now do what fitness trackers did five years ago.

Apple introduced advanced conversational AI features for AirPods Pro in March 2025, enhancing real-time noise suppression and personalized spatial audio. While not explicitly health-focused, the biometric sensing capabilities in AirPods are expanding.

Google researchers demonstrated that headphones with active noise cancellation can track heart rate using just the existing ANC microphones — no additional hardware required. That's the kind of innovation that makes every earbud a potential health device via software update.

The ear is actually an ideal location for certain biometrics. It's close to the carotid artery, stable during movement, and people already wear earbuds for hours daily. The form factor problem is already solved.

Where this is heading

2026 is when earbuds become legitimate health tracking devices, not just audio accessories with bonus features. The always-on nature of earbuds during workouts, commutes, and work calls creates continuous monitoring opportunities that wrist-based devices miss.

Hearing health is the obvious application — think real-time hearing protection, early detection of hearing loss, and personalized audio optimization. But the biometric possibilities go further: stress detection via voice analysis, fatigue monitoring, even early flu detection via body temperature.

The competition will be between purpose-built health earbuds and mainstream earbuds adding health features. Apple's massive AirPods installed base means any health feature they add immediately reaches hundreds of millions of users.

7. Femtech Wearables Are a $235 Billion Opportunity

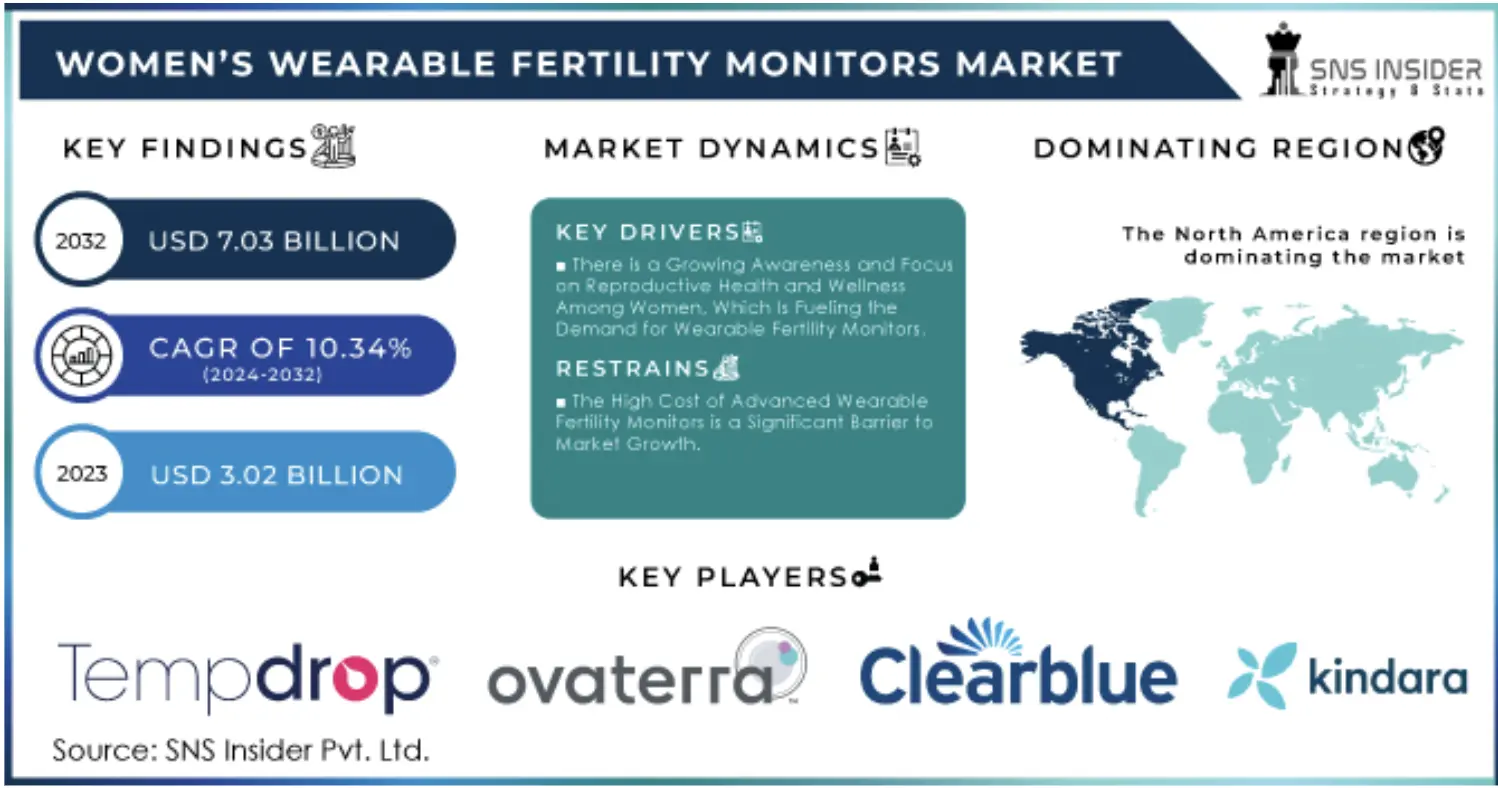

Women's health technology is one of the most underserved and fastest-growing segments in wearables. According to Persistence Market Research, the global fertility tracking market is projected to grow from $92.8 billion in 2025 to $235.6 billion by 2032 — a 14.2% CAGR.

The adoption numbers are striking: nearly 50% of U.S. women aged 18-45 now use digital tracking solutions for reproductive and menstrual health. That's up significantly from around 35% before the 2022 Dobbs decision.

Wearables are becoming the preferred method. According to SNS Insider research, devices with advanced sensors accounted for 48% of women's wearable fertility monitor sales in 2023, driven by demand for high-precision cycle tracking.

The technology has matured significantly. Academic research published in AJOG found that wearable fertility trackers "had high accuracy for detecting fertility and were able to differentiate between the luteal phase, fertile window, and menstruation by assessing changes in heart rate, heart rate variability, temperature, and respiratory rate."

What's happening in the real world

Flo Health became the first purely digital women's health app to achieve "unicorn" status in July 2024, raising $200 million from General Atlantic at a valuation over $1 billion. They've since been integrating with wearable devices for more accurate tracking.

Natural Cycles is the only FDA-cleared birth control app, using basal body temperature tracking. When paired with their thermometer or a wearable like Oura, accuracy improves significantly over manual tracking.

Oura has leaned heavily into women's health, with their ring tracking the subtle temperature shifts that indicate cycle phases. The passive, overnight measurement is more accurate than morning temperature readings.

Ava makes a dedicated fertility-tracking bracelet worn during sleep, measuring nine physiological parameters. Clinical studies showed it detected an average of 5.3 fertile days per cycle with 89% accuracy.

In June 2025, Irish startup Joii raised €2.4 million for an AI-enabled menstrual monitoring solution that quantifies blood volume and clot size — pushing into diagnostics territory.

Where this is heading

2026 femtech wearables get more diagnostic, not just tracking-focused. The current generation tells you where you are in your cycle. The next generation identifies potential health issues — PCOS indicators, endometriosis patterns, perimenopause signals — based on physiological data.

The regulatory path is interesting. As these devices demonstrate clinical accuracy, FDA clearances become possible, which opens up insurance reimbursement and medical integration. Natural Cycles showed it's possible; more will follow.

Privacy remains the elephant in the room. Post-Dobbs, many women are rightfully cautious about digital menstrual tracking. Devices that process data locally (like Oura) have an advantage over pure cloud-based solutions. Expect privacy to be a major competitive differentiator.

The Common Thread

Look at these seven trends together and a pattern emerges: wearables are graduating from "interesting data" to "actionable health intelligence."

Smart rings succeed because they track what matters (sleep, recovery, readiness) in a form factor that doesn't interrupt your life. Smart glasses succeed because AI finally gives them a compelling use case. Clinical-grade monitoring succeeds because the sensors are accurate enough to trust. Sleep tracking succeeds because everyone knows sleep matters but few know how to improve it. AI succeeds because raw data without interpretation is useless.

The companies winning aren't the ones with the most sensors or the biggest screens. They're the ones answering the question: "What should I do differently based on this data?"

That's the bar for 2026. Your wearable shouldn't just tell you that your HRV dropped overnight — it should tell you to skip the intense workout and take a recovery day instead. It shouldn't just track your cycle — it should flag when something looks abnormal and suggest talking to your doctor.

The wearable that succeeds in 2026 isn't the one that collects the most data. It's the one that helps you make better decisions with the data it collects.

If you're evaluating wearables this year, don't ask "what does it track?" Ask "what does it help me do?"

Want to spot emerging technology trends before they hit mainstream? Check out our guide on how to identify market trends or explore what's gaining traction on our trends dashboard.