The way we live and decorate is shifting faster than ever.

From high-tech design tools to eco-chic décor and retro collectibles, 2026's top home trends reflect big changes in lifestyle and values.

In this article, we'll break down 7 mega trends shaping homes in the U.S. and Europe – with data, examples, and tips on who's leading the charge.

Whether you're a homeowner, renter, or just love keeping your space on-trend, these are the macro shifts to watch. For entrepreneurs looking to capitalize on these trends, understanding market demand is crucial – learn how to use Google Trends to find profitable niches.

Let’s dive right in.

We will cover a quick overview of each trend, why it’s booming now, key sub-trends, market stats, and the companies riding the wave.

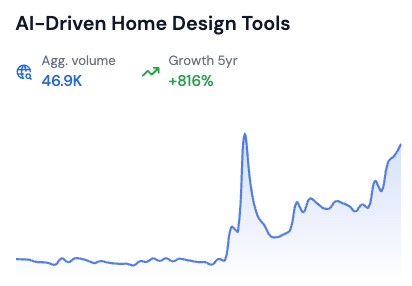

1. AI Home Design Tools

Generative AI and augmented reality are making home design instant and accessible . Imagine snapping a photo of your living room and within seconds trying out new décor styles, layouts, or paint colors – all virtually.

That’s now reality.

These AI-powered design apps collapse the cost and time it takes to plan a renovation or redecorate. Consumers have a self-serve mentality , bypassing traditional interior designers to experiment on their own screens.

In fact, the global home design software market (which includes interior design apps and AR tools) was valued around $3.5 billion in 2024 and is growing about 8–9% annually .

The momentum is clear: as more people embrace DIY designing with tech, the market is expected to keep expanding worldwide.

Trend Drivers

Post-pandemic, homeowners got comfortable trusting YouTube and apps over contractors for design ideas.

Tech advancements in AI image generation and AR mean even a non-professional can get realistic 3D previews of a redesigned room.

This trend is empowering consumers to take creative control. Retailers see an opportunity too – major hardware stores and paint brands are embedding these AI/AR engines on their websites and apps to keep shoppers engaged.

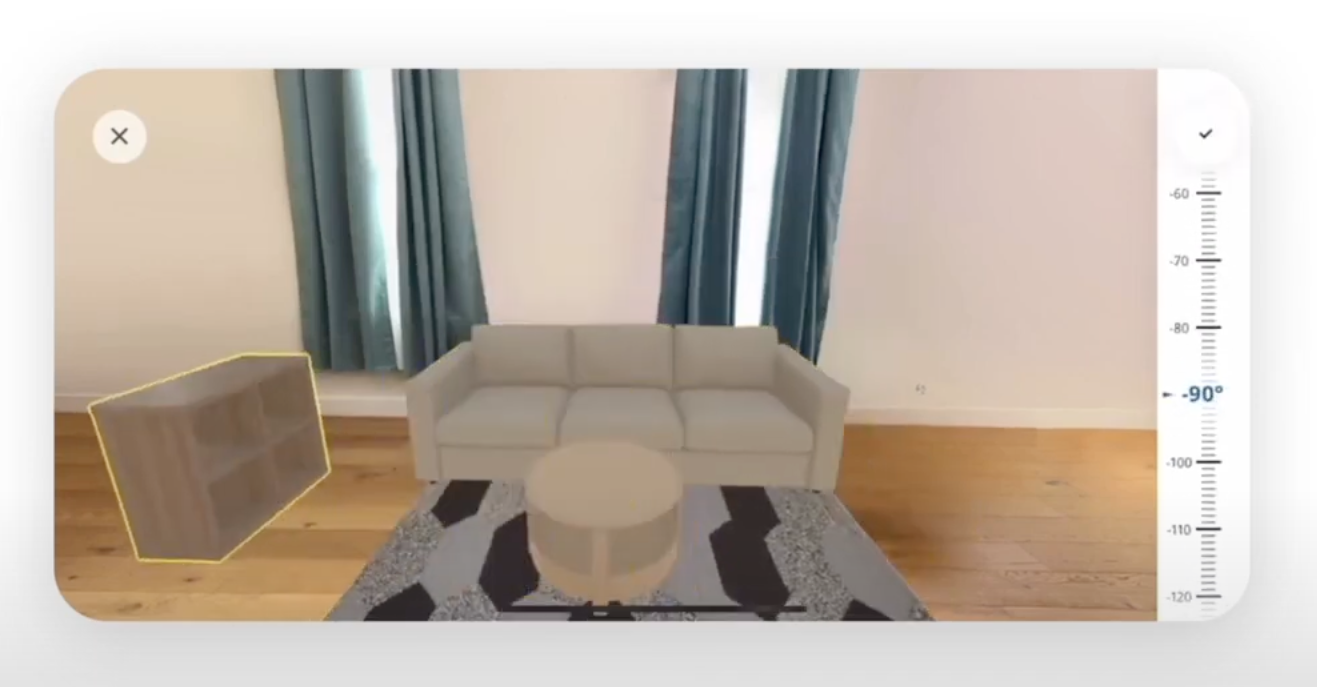

For example, IKEA launched an AI-powered “IKEA Kreativ” app that lets customers scan their room and try furniture in 3D.

Similarly, Home Depot’s Project Color app allows you to preview paint on your walls via AR. Amazon, Wayfair, Target and others have all rolled out AR features so you can virtually place that couch or lamp before buying.

The benefit for retailers is huge: inspiration can turn directly into a purchase, all in-app, without the customer ever leaving to seek a designer’s help.

Sub-trends

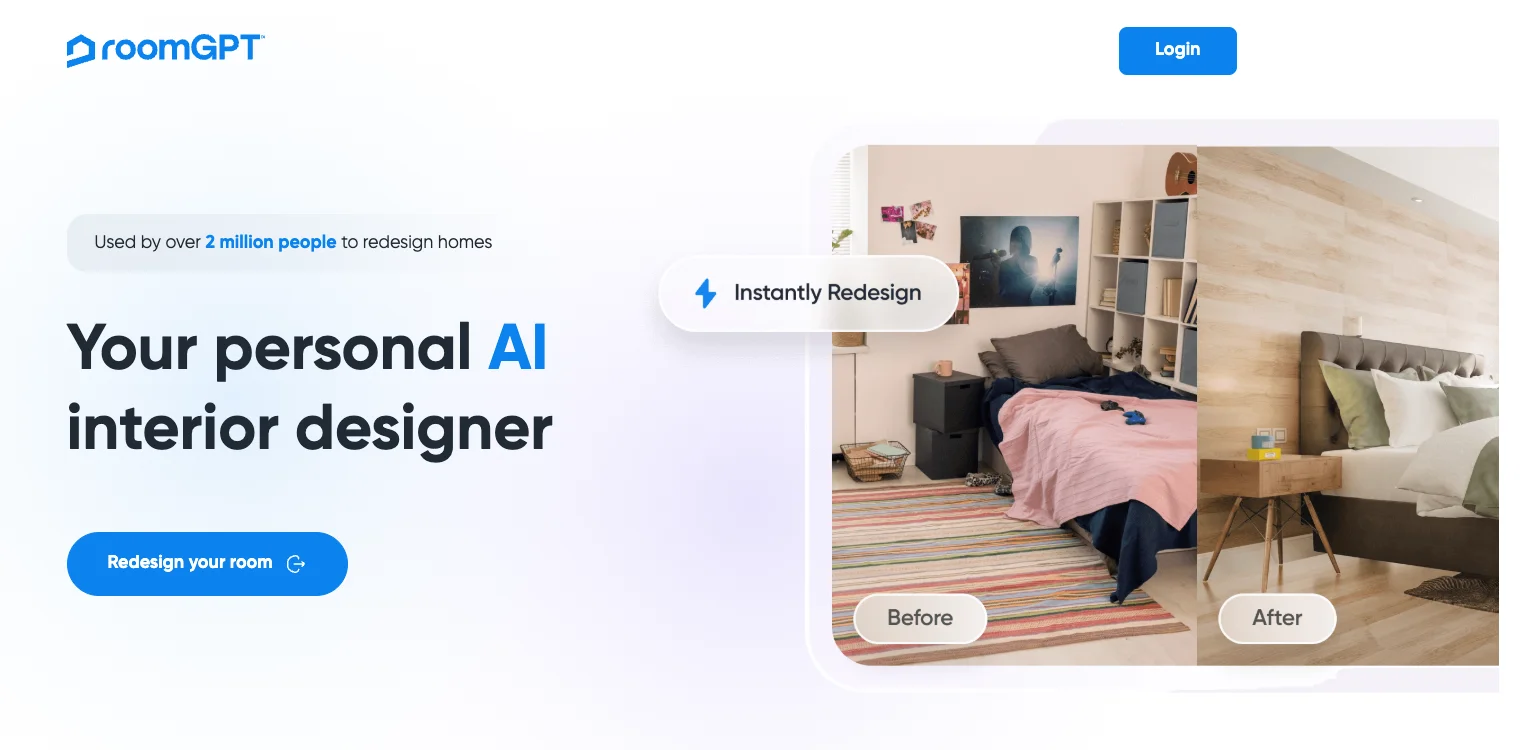

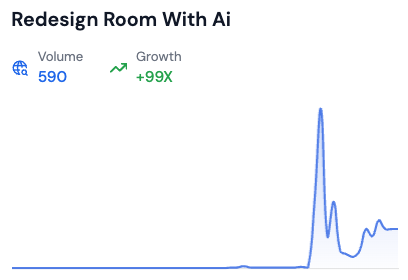

Hot sub-trends In this space include things like AI interior design generators (e.g. RoomGPT or InteriorAI for re-imagining your room from a photo), virtual staging tools for real estate, and AR measurement and layout apps .

Searches for " redesign room with AI " and " remodel AI app " are trending, showing people's appetite to experiment with décor digitally. To track these emerging trends effectively, explore our guide on Google Trends alternatives for comprehensive market research.

Even paint companies have joined in: apps from Behr and Sherwin-Williams let you virtually test paint colors on your walls ( “paint matching app” searches are up).

All of this points to a DIY design revolution – where anyone can be their own interior decorator with a little tech help.

Key Players

A mix of innovative startups and big brands.

On the startup side, tools like Collov AI and Spacely AI offer AI-driven room makeovers at the click of a button.

Established design software companies (Autodesk, SketchUp, etc.) are adding AI features to stay relevant.

Retail giants are partnering with AR innovators – for instance, IKEA’s app leverages AI algorithms from a Silicon Valley lab it acquired.

And don’t forget online design communities: Houzz’s “View in My Room” and Lowe’s and Home Depot’s AR features keep improving.

The bottom line is that designing and visualizing your home has never been easier or more fun , and companies that make it ultra-simple (or even free) to preview changes are winning over millions of users.

2. Modular Living for Compact Spaces

The Transformer Table can extend from a small console to a full dining table, illustrating the demand for versatile, space-saving furniture. Every cubic inch counts when home prices and rents soar.

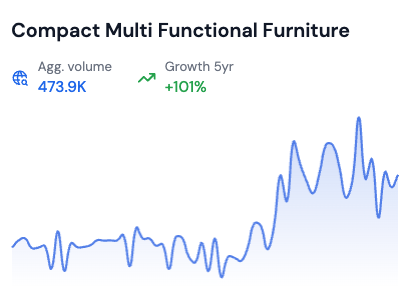

Modular, multi-purpose furniture is now a must-have, especially as urban dwellers and remote workers strive to do more in less space.

Think of a bookshelf that swivels to reveal a desk, or a bed that folds into the wall – these clever designs are going mainstream.

With people spending more time at home (often in apartments), the lines between living, working, and sleeping areas blur. Demand is surging for furniture that morphs, stacks, or hides away when not in use.

The market for multifunctional & space-saving furniture reflects this boom. One recent analysis pegged it around $7–8 billion globally in 2023 , with about 6–7% CAGR through 2030.

In other words, it’s growing faster than the overall furniture market as consumers prioritize flexibility.

Another report noted folding furniture alone could exceed $13.8 billion by 2030 .

The appeal isn’t just for tiny studio apartments – even larger homes are embracing modular pieces for flexibility and sustainability . Why buy a single-use piece when you can have one that adapts?

What’s driving it?

Urbanization and high housing costs top the list.

In many cities, new homes are shrinking – the average new house size in the U.S. dropped to its smallest in 13 years (around 2,400 sq. ft. in 2023).

Smaller spaces force creative furniture solutions. Remote work also means home offices pop up in bedrooms or living areas, so furniture that can convert (a table to a desk, a couch to a bed) is gold.

Consumers also care about sustainability : a modular sofa you can add sections to or repair means less waste than buying a whole new set.

Brands that ship easy-to-assemble, swappable modules tout eco-friendliness and long-term value.

Sub-trends

include classic space-savers like sofa beds and Murphy beds , but also new concepts: “ transformer table ” (a dining table that expands, like the one above), rotating bookshelves that double as room dividers, and foldable wall desks for impromptu workspaces.

Even TikTok-famous items make the list: the “boneless couch” (an ultra-modular couch that you can reconfigure freely) and the “ marshmallow bed frame ” (known for its removable, cushy pieces) have cult followings.

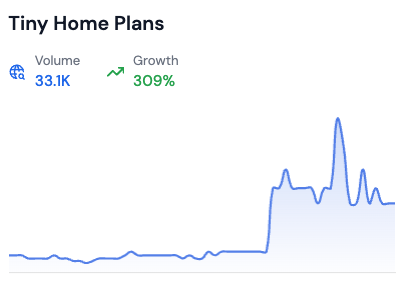

Tiny home living solutions are popular too, as seen in searches for “tiny home plans” as demonstrated by chart below from Rising Trends.

There’s also clever storage like beds with built-in drawers (hello, IKEA MALM bed).

Who’s leading?

Unsurprisingly, IKEA has long championed small-space living with affordable modular designs (from sectional sofas to modular shelving). They even launched new lines like a gaming desk that folds into a cabinet, complete with hidden storage and cord management.

High-end innovators are in the game too – for example, Resource Furniture offers premium wall beds and transformable sofas (their latest motorized wall bed systems come with built-in nightstands and desks).

On the startup side, Canada’s Transformer Table went viral and reportedly hit $100M in annual sales by 2024 through clever social media marketing. The Transformer Table’s viral video (300+ million views) led to a tripling of sales and expansion to 35 countries , showing the global appetite for these solutions.

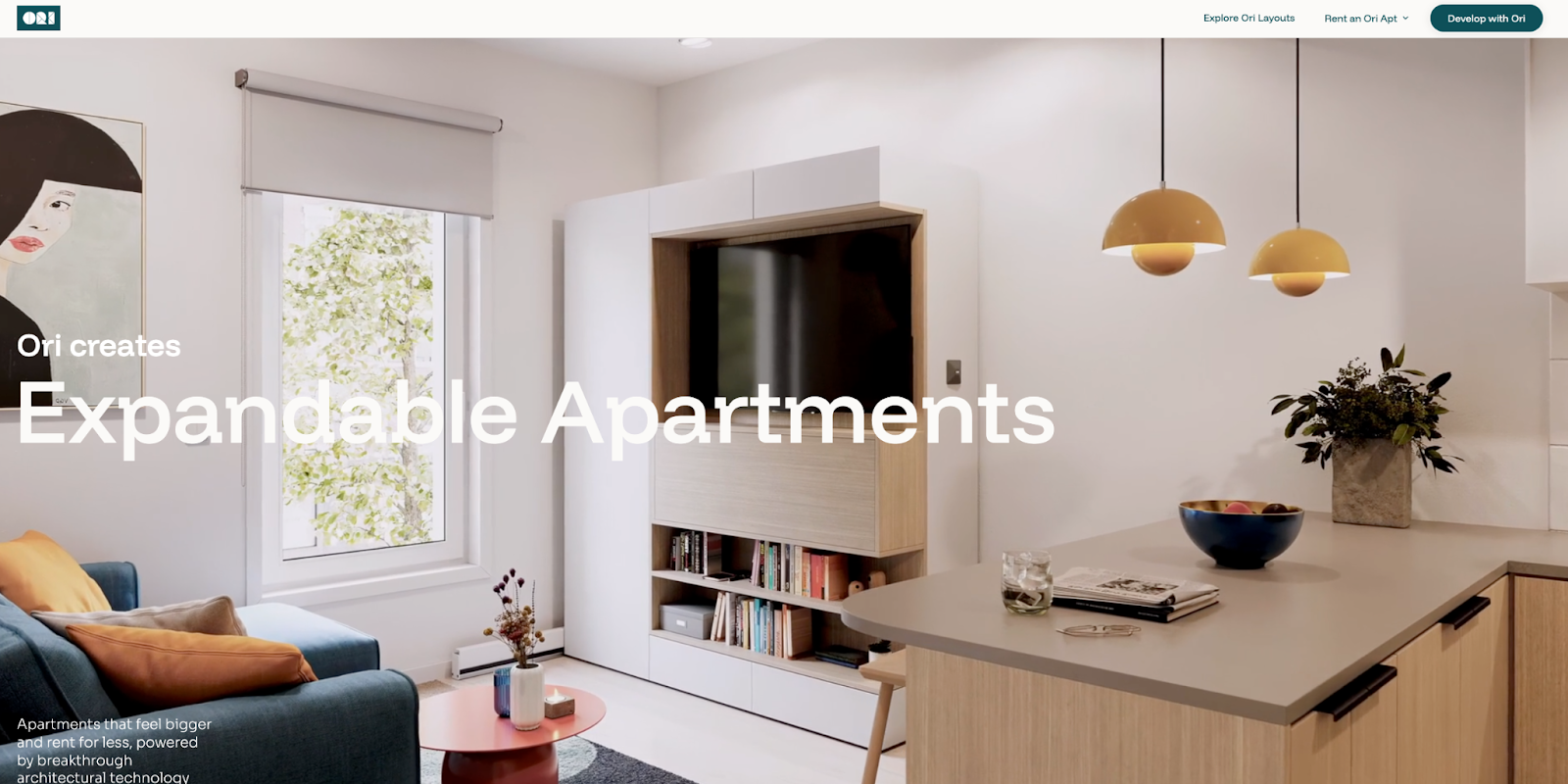

Other notable players include Ori Living (robotic furniture for micro-apartments) and Clei (Italian maker of high-end transforming beds).

Even retailers like Wayfair and Overstock have dedicated “small space” sections, and rental services have popped up to provide subscription furniture that you can swap as your space needs change.

All signs point to modular furniture becoming a staple of modern living, not just a niche – and companies that combine convenience (tool-free assembly, quick shipping) with clever design are earning loyal fans.

3. Eco-Comfort Textiles & Wellness Décor

Comfort at home now comes with a clean conscience . Shoppers (especially Gen Z and Millennials) want their sheets, towels, and décor to not only feel good but do good for the planet and their well-being .

Enter the era of eco-comfort and wellness décor – where bedding is organic, candles are toxin-free, and even rugs might be made of recycled fibers. The idea is that a healthy home environment (non-toxic, sustainable, and perhaps even therapeutic) leads to a healthier life.

This isn’t just a niche hippie trend; it’s a big business. The sustainable home textiles and decor segment was estimated around $85 billion in 2024 , growing at roughly 5–6% CAGR through the end of the decade.

That growth is propelled by young consumers who came of age with eco-fashion and are now applying the same ethos to their homes. In other words, “green” is the new cozy . And these shoppers are often willing to pay a premium for organic, ethically made, or wellness-enhancing home products.

What does “wellness décor” include?

It spans a range of products: organic cotton or bamboo bedsheets that are free of harmful chemicals, plant-based foam mattresses with low VOC emissions, aromatherapy diffusers and candles made from soy or beeswax, air-purifying indoor plants (and stylish planters to put them in), and even things like EMF-shielding curtains or calming color lighting.

The story behind products matters too.

Brands proudly share if an item is made from recycled materials or if it supports artisan communities.

According to research, this storytelling around traceable natural fibers, low-toxin finishes, and added health benefits is what lets companies charge premium prices – because consumers perceive real value in it.

Sub-trends

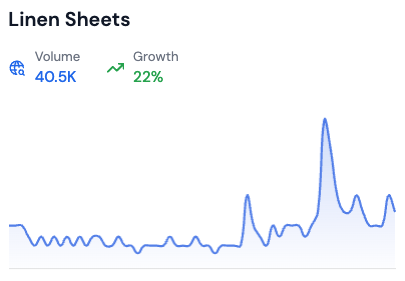

On the materials side, linen and hemp fabrics are making a comeback (breathable, durable, and requiring fewer pesticides to grow).

Searches for “linen sheets” and “vegan silk” (e.g. bamboo silk alternatives) are up.

Also popular are “ diatomite bath mats ” – these are quick-drying stone-like mats made from natural diatomaceous earth, a hit for their mold-resistant, no-laundry appeal.

In décor, natural crystals and minerals are in demand as decorative objects that supposedly carry wellness vibes (e.g., black tourmaline or orgonite pyramids for energy, which appear in trending searches).

Toxin-free candles and diffusers are booming too – for example, Antique Candle Co . (known for soy candles) or luxury brands like Loewe releasing high-end room sprays. Even paint is going wellness: low or zero-VOC paints and “smart” air-purifying paints are being marketed to health-conscious homeowners.

Who’s profiting?

A slew of new and established brands. In bedding and bath, companies like Coyuchi and Boll & Branch have built reputations on organic cotton and sustainability.

Piglet in Bed (a UK brand) has gained a following for its relaxed, breathable linen bedding. Big-box retailers are also jumping in: IKEA and Target now carry lines of sustainably sourced textiles (IKEA’s for instance has an entire eco-friendly cotton line).

For wellness-focused decor, look at boutique brands: Vitruvi and Saje for natural diffusers and essential oils, The Citizenry for artisan-made throws and pillows, or Avocado (better known for mattresses) now selling organic wood furniture and sheets.

Even tech is blending in – smart air purifiers doubling as design pieces, and lighting companies promoting circadian rhythm LED lights that adjust color temperature to support better sleep.

At the luxury end, designers are incorporating wellness rooms in homes – spaces for meditation, filled with greenery and calming decor. Real estate developers advertise "wellness buildings" with features like vitamin C-infused shower water and circadian lighting systems. This home wellness movement extends to sleep optimization – see our data-driven analysis of sleep trends in 2026 for insights on grounding sheets, sleep supplements, and bedroom wellness products driving consumer demand.

It’s clear that “home wellness” is more than a buzzword : it’s a lasting trend.

Consumers see their home as a sanctuary for both body and soul, and they’re aligning their purchase choices accordingly – opting for the duvet made of organic kapok fiber and the sofa made with formaldehyde-free glue.

Companies that can prove their products are healthier for people and planet (and can back it up with certifications or data) are earning trust and loyalty in this space.

Sustainability extends beyond home design into every aspect of consumer life, including food choices. The same eco-conscious mindset driving home improvement trends is also fueling demand for sustainable food systems. Learn about these parallel developments in our comprehensive guide to sustainable food systems and how they're reshaping both homes and diets. This wellness-at-home mindset is also driving demand for clean supplements – explore our supplement trends report for 2026 to see how consumers are building wellness routines around magnesium, adaptogens, and gut health products.

4. DIY & Digital Home Upgrades

Why hire a contractor if you can do it yourself (with a little digital help) ? The DIY home improvement craze is still going strong in 2025. During lockdowns, millions learned to rely on YouTube tutorials and got a taste of renovation work firsthand – and they aren't turning back. For businesses looking to capitalize on this DIY trend, check out our analysis of Exploding Topics alternatives to discover emerging opportunities in the home improvement space.

Now, homeowners (and renters) are tackling everything from installing vinyl flooring to building decks, armed with how-to apps, AR guides, and an array of peel-and-stick products that make projects easier.

This DIY movement is value-driven and self-reliant : people want to save money, gain skills, and have the satisfaction of upgrading their space personally.

The market numbers are massive. Various estimates put the global DIY home improvement market in the $800–900 billion range in 2024 .

For instance, one analysis reported about $ 857 billion in 2024 growing to over $1.1 trillion by 2031, which is roughly a 4–5% annual growth rate .

Another source pegs the DIY segment at $0.87 trillion in 2024 , on track for $1.17T by 2030 (around 6% CAGR ).

No matter how you slice it, that’s a huge share of the home improvement pie – and it reflects not just affluent homeowners, but also middle-class folks choosing sweat equity over paying professionals.

What’s fueling it?

A big factor is online knowledge-sharing . Platforms like YouTube, Instagram, and Pinterest are loaded with DIY project inspiration and step-by-step guides.

The phrase “ YouTube University ” is no joke – search for “how to tile a backsplash” or “how to install a ceiling fan” and you’ll find thousands of videos. This abundance of free education lowers the barrier for beginners.

Retailers have taken note: Home Depot and Lowe’s produce their own how-to content and offer tool rental services for DIYers.

The rise of “renter-friendly” upgrade products is another boost – for example, peel-and-stick wallpaper and floor tiles that can be removed easily (huge search spikes for these, as noted by trend analysts).

These let even renters personalize without risking their deposit. Economic factors play in as well; with inflation, hiring a contractor is costly, so many opt to do small jobs themselves and save money.

Trending Topics

The DIY world has its own hot products.

To name a few: “ peel and stick wallpaper ” and “magnetic wallpaper” for easy wall makeovers, stick-on backsplash tiles , and adhesive hooks/strips (like the Command brand) for damage-free hanging.

Painting has gone DIY-friendly with things like one-coat primers and even “mold killing primer” for those tackling old bathrooms.

Flooring is another area. Searches for Luxury Vinyl Plank (LVP) options like “Home Depot LVP flooring” are high because products have become more user-friendly to install.

There’s also a digital angle: “wall printing machine” is an emerging concept where a device literally prints murals on your wall – a nod to how tech and DIY are merging.

And beyond the building itself, hauling and recycling are part of the trend: people look up “ who will pick up old furniture for free ”, showing interest in responsible disposal or repurposing of old items during upgrades.

Key Players

The obvious winners are the big home improvement retailers: Home Depot, Lowe’s, Menards in the US; B&Q, Bauhaus, Leroy Merlin in Europe. They’ve seen robust sales as DIY activity stays elevated.

These companies are blending digital and physical – offering project calculators on their websites, AR measurement tools , and even live chat experts to guide users.

Home Depot reported a strong DIY segment and has expanded its tool rental program, while Lowe’s has invested in AR apps and how-to content.

On the tech front, startups are emerging to support DIYers: for example, apps that use augmented reality to tutor you through a repair (imagine pointing your phone at a leaky faucet and an AR overlay shows which part to turn – such concepts are in development).

Retail chains also partner with influencer handymen/handywomen on social media to promote projects and products.

Another growing segment is the online marketplace for recycled materials . Companies like Facebook Marketplace, OfferUp , or local reclamation yards benefit as DIYers look for second-hand doors, lumber, or fixtures to save money and upcycle.

There’s a push for eco-conscious DIY, so retailers offering recycling of old appliances or paint (like Home Depot’s haul-away or recycling programs) build goodwill. And let’s not forget the community aspect: forums on Reddit (r/HomeImprovement) or specialized sites allow people to troubleshoot problems together.

All of this creates an ecosystem where DIY isn’t just a hobby – it’s a movement . The businesses that thrive are those that empower the average person to feel like a capable handy-person, through better products, support, and digital tools.

As one industry report succinctly put it, DIY retail is capturing this spend “while building community credibility” – meaning trust and engagement with the customer is as important as the products themselves.

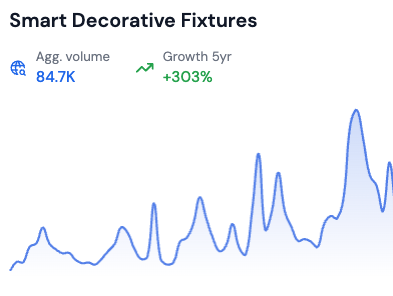

5. Smart Sensory Lighting & Fixtures

Home lighting has moved far beyond the old flip of a switch. In 2025, lighting and fixtures are “smart” and sensory-rich , turning the home into a customizable experience at the tap of a phone or a voice command.

We’re talking color-changing LEDs that sync with your music, ceiling fans with built-in Bluetooth speakers and thematic designs, and even bathrooms equipped with spa-like lighting that simulates a thunderstorm or a sunrise. Lighting is no longer just about utility; it’s mood, entertainment, and personalization.

The smart lighting market has been growing rapidly alongside the broader smart home trend. By 2024, the global smart lighting market reached roughly $19–20 billion in size. Analysts expect it to quadruple by 2033 (to ~$77 billion) with high growth in the mid-teens CAGR.

Another research group noted a ~ 16.8% annual growth from 2025–2033 for smart lighting, making it one of the faster-growing home tech segments.

Driving factors include the push for energy-efficient LEDs, falling prices of smart bulbs, and the fact that many new homes (and renovations) are being outfitted with smart capabilities by default.

What’s included in “sensory” lighting?

On one hand, it’s about smart control – app or voice-controlled lights, smart bulbs (like Philips Hue, WiZ , or LIFX) that can change color or warmth, and integrated systems that can do things like geofence your arrival (lights turn on when you’re near home) or mimic occupancy for security.

On the other hand, it’s about ambiance and novelty .

Think permanent holiday lights along your roofline that you program for different seasons (companies like JellyFish Lighting offer exactly this – color-changing LEDs installed under your eaves so you never hang Christmas lights again).

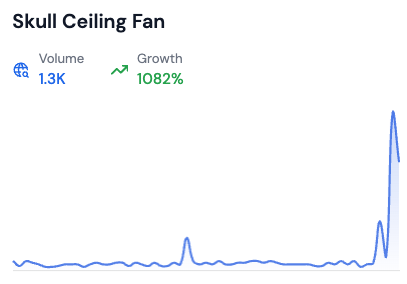

Or ceiling fans that are statement pieces – one trend example: searches for “skull ceiling fan” show people even want their fixtures to reflect personal style.

There are also “storm simulation spas” – essentially fancy bathroom or sauna setups with integrated sound and lighting to simulate rainstorms or forest canopies, giving a multi-sensory relaxation experience at home.

Even outside the home, landscape lighting synced to music or occasions is trending.

Sub-trends

Voice-ready fixtures are a big one. Many fixtures now come with Amazon Alexa or Google Assistant compatibility out of the box, so you can say “dim the living room lights” or “set spa mode” and the devices respond.

Retrofit smart kits are important too – gadgets like smart light switch adapters or screw-in modules that make existing lamps “smart” without re-wiring, which is great for renters.

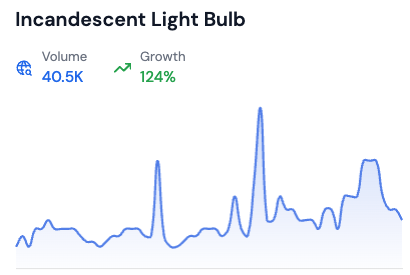

Searches for old tech like “ incandescent bulb ” still exist but mainly because people are nostalgic or repurposing vintage lamps; LED is now king.

In fact, regulations in many places are phasing out older bulbs, pushing consumers to smart LEDs.

Also noteworthy: theatrical and event lighting effects for home .

Projectors and smart LEDs can turn a living room into a Halloween haunted house or a party zone. Companies have noticed this crossover from events to residential – e.g., Philips Hue offers preset “scenes” and there are products like Twinkly strings that were meant for holidays but get used year-round for décor.

Key Players

Several types of players:

- Big Lighting/Tech Companies:

Signify (Philips Hue) is a leader in smart bulbs and has a vast ecosystem of lights and accessories.

They, along with ams-OSRAM , GE Lighting (Savant) , Legrand , and Lutron , dominate the market and keep pushing out new tech.

For example, Signify partnered with Honeywell to integrate smart lighting into commercial building systems. These large firms ensure compatibility and reliability, making them popular for both DIY smart homes and professional installations.

- Niche Smart-Home Brands:

Nanoleaf is worth mentioning – they make those geometric light panels you might’ve seen on TikTok or gaming setup photos.

They cater to the aesthetic/mood lighting crowd. Sengled and Yeelight (Xiaomi-backed) offer budget-friendly smart bulbs and have gained traction globally.

There are also companies like Govee providing LED light strips and ambient products favored by gamers and younger consumers.

- Fixture Makers & Startups:

Some companies take ordinary fixtures and add a twist. For example, Artika makes stylish LED ceiling fans (some with smart features).

Startups are producing things like smart lamps that project stars on the ceiling for kids , or bathroom mirrors with LED ring lights and voice assistants built-in. Another fun niche: novelty fans and fixtures – one trend was the “industrial” or themed fans (like a ceiling fan that looks like an airplane propeller for a kid’s room, or the aforementioned skull design for a man cave).

These may not be “smart” per se, but they tie into personalization. And many can be retrofitted with smart switches.

- Integrated Smart Home Systems:

Companies like Caséta by Lutron or Leviton offer smart switches and whole-home lighting systems that appeal to the serious smart home enthusiast or luxury home market.

These ensure every light (even dumb bulbs) can be part of a scheduled or voice-controlled scene.

What’s interesting is how accessible smart lighting has become . You can buy a basic smart bulb for $10–15 now and screw it into a lamp, connect to your phone, and voila – voice-controlled mood lighting.

This mass affordability drives adoption. It’s no wonder analysts see double-digit growth continuing.

As more people discover that lighting can do more than just illuminate – it can set a vibe, improve sleep (with warmer tones at night), enhance security, and just be plain fun – they invest in upgrading from old-school fixtures.

For 2025 and beyond, expect your home’s lights to be as much about software and scenarios as about wattage.

The companies to watch will be those integrating lighting with other smart home aspects (thermostats, security, audio) to create seamless experiences, and those that manage to make installation of smart fixtures as DIY-friendly as setting up a new smartphone.

6. Nostalgia & Pop Collectible Décor

Your Funko Pops and Pokémon cards aren’t just hiding in the closet anymore – they’re proudly on the living room shelf. Nostalgic and pop culture collectibles have invaded home décor , and adults are unapologetically displaying their fandoms.

From LEGO models doubling as decorative art to limited-edition movie merch becoming centerpieces, this trend is all about blurring the line between toys and décor. It turns out “kidult” collectibles bring joy and personality to a space, and can even be savvy investments.

How big is this market? Absolutely huge. The global collectibles market – which includes everything from sports memorabilia and comic books to designer toys – was estimated around $458 billion in 2022 . It’s on track to cross $1 trillion by 2033 at roughly 6%+ annual growth .

A chunk of that is now bleeding into home goods as companies produce decor-oriented collectibles (think LEGO’s “Botanical” series of buildable flowers and plants, which specifically target adults as display pieces). Market Decipher, a research firm, noted that new categories of collectibles are gaining traction and driving the market up in 2023 ( source ).

Essentially, what used to be niche (like anime figures or retro gaming consoles as decor) is now mainstream. Social media plays a role here too: everyone loves sharing their decked-out office backdrop or themed media room, fueling a bit of FOMO and inspiration.

Why the nostalgia boost?

Culturally, a few things are at play. Millennials and Gen X, who grew up in the 80s, 90s, and 2000s, now have spending power and a desire to reconnect with childhood favorites – but in a grown-up way.

The pandemic also saw people stuck at home seeking comfort in nostalgia (witness the surge in puzzles, LEGO sets, etc. for adults). Companies responded with limited drops and collaborations that create hype.

For example, IKEA collaborated with LEGO on storage boxes ; fashion brands put out home items themed to cartoons; even brands like Le Creuset release cookware in themed colors (Star Wars pots, Harry Potter spoon sets, you name it). These limited editions tap into collector mindsets – scarcity drives up perceived value.

Hot sub-trends/examples:

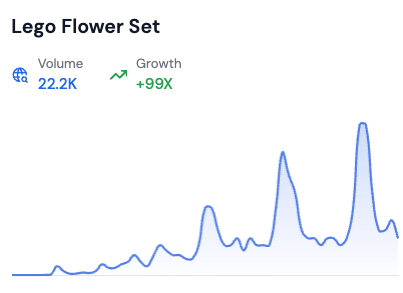

One fun one is LEGO decor .

LEGO realized adults were buying kits to display, so they launched the LEGO Botanicals collection (flower bouquet kits, bonsai tree kit, etc.) which has been a hit – you get the joy of building and a cool décor piece at the end.

Searches for “LEGO flower set” , “LEGO botanicals” have been strong.

Another is fandom wallpaper and textiles : yes, you can get Hello Kitty wallpaper or Marvel-themed curtains now.

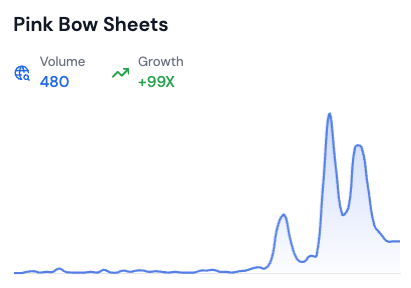

Pottery Barn Teen, for instance, offers Hello Kitty and Harry Potter home collections. Nostalgic patterns like ’90s Lisa Frank-style or retro gaming iconography are coming back on throw pillows and bedsheets (note trends like “pink bow sheets” reminiscent of Hello Kitty aesthetics, or “Snoopy bed sheets” for Peanuts fans).

There’s also the general ’80s and ’90s retro revival in color schemes and styles – neon signs, vintage arcade posters, vinyl record players as decor, etc. Even high-end design is playing with nostalgia: we see Memphis design style furniture (a very 1980s look) making a comeback as quirky statement pieces.

Crucially, social media amplifies this. Unboxing videos and shelfie photos create buzz around collectibles. A limited-run décor item (like only 100 made of a certain art toy lamp) can sell out in minutes, then resell at a premium – turning decor into an asset class of sorts.

The fear of missing out (FOMO) drives many to snag that item when it drops. Market Decipher mentioned how social media and scarcity together let companies charge premium mark-ups – because buyers view these pieces as not just decor, but investments or at least valuable keepsakes.

Who’s cashing in?

A mix of toy companies, entertainment franchises, and savvy retailers.

LEGO is definitely one (their adult portfolio now includes wall art mosaics, famous paintings re-created in bricks, etc., all meant to be hung up or displayed).

Funko , known for Funko Pop! figures, has expanded into making home accessories featuring pop culture icons.

Big IP owners like Disney, Nintendo, Marvel, DC license their franchises to all sorts of home product makers.

For example, you can buy an Infinity Gauntlet mood lamp or a Super Mario question block nightlight – these are officially licensed and target adults as much as kids. Etsy sellers and independent artists also thrive here, offering unique takes like Pokemon-themed planters or vintage comic collages.

On the retail side, stores like BoxLunch or Hot Topic (and online retailers like ThinkGeek/GameStop ) specialize in fandom merchandise that includes home decor.

Even mainstream retailers have sections for “geek chic” decor now. High-end auction houses and marketplaces (e.g., Goldin Auctions featured in Netflix’s “King of Collectibles”) bring collectibles more into the public eye, which spills over to everyday fans wanting a piece of the action.

One interesting entrant is the luxury collectibles crossover: brands like Bearbrick (Medicom) produce limited designer art toys that people display like sculpture, sometimes costing hundreds or thousands of dollars each.

These often appreciate in value. So an artsy homeowner might have a Bearbrick on their shelf instead of a vase. It’s all part of the same trend: home décor as an expression of personal passions and nostalgia . No longer does your living room shelf only hold fine china; it might hold an array of Star Wars helmets, vintage cameras, or a mix of books and LEGO builds – and that’s not just accepted, it’s celebrated.

For businesses, this trend opens up new product lines. Furniture companies might release a limited chair upholstered in classic comic strip fabric. Wall art companies are doing brisk business in vintage travel or concert posters.

As long as it triggers a happy memory or a conversation (“Oh, I remember those!”), it has a place in this trend. And consumers are proving that they’ll spend on these items: not purely functional, but functional + emotional . In 2025, a living space that tells your personal story – even if that story includes childhood cartoons or beloved sports teams – is totally on-trend.

7. Curated & Circular Furniture Retail

Big-box furniture stores and generic catalogues are so yesterday. The new wave in furniture retail is all about curation, storytelling, and second-hand gems . In 2025, consumers hunting for furniture aren’t just hitting IKEA or department stores; they’re exploring curated online marketplaces, pop-up showrooms, vintage fairs, and even Instagram feeds of influencers’ stylish homes.

At the same time, the circular economy is gaining ground – meaning second-hand furniture (and the recommerce of home goods) is booming as sustainability and uniqueness drive purchases. For trend hunters looking to spot these emerging patterns early, our guide on Trend Hunter alternatives provides valuable insights into identifying market opportunities.

Let’s talk size: the global second-hand furniture market was roughly $34 billion in 2023 , and forecasted to reach about $56+ billion by 2030 (that’s ~7–8% CAGR, significantly outpacing traditional retail furniture growth).

Statista had a similar figure, citing ~$32.6B in 2023 with around 8% growth per year. This includes everything from thrift store finds to upscale antique trading.

It’s not surprising – buying used not only often saves money, but aligns with eco-conscious values. In North America alone, second-hand furniture sales made up nearly one-third of the global revenue in 2023.

Key Drivers

Younger buyers are big drivers : millennials and Gen Z account for a huge portion of these purchases, drawn by the hunt for unique pieces and the appeal of reuse.

But it’s not just about second-hand. “Curated retail” means retailers (or platforms) carefully select collections that tell a story or cater to a certain aesthetic, rather than offering a bit of everything.

Picture a boutique that sells only mid-century modern pieces in pastel colors , or an online site where every item is vetted for quality and style consistency. Consumers are showing they’ll flock to these curated experiences. It’s akin to how we use playlists in music – now there are “furniture playlists” put together by experts or algorithms.

Trends within this trend

- Online marketplaces for furniture resale:

We’re seeing the rise of platforms like Chairish , 1stDibs, Kaiyo, AptDeco, Facebook Marketplace and many more. These range from high-end antiques (1stDibs) to local second-hand bargains (FB Marketplace).

Notably, these platforms add trust signals : Chairish, for example, often has professional curation and approval for listings; Kaiyo and AptDeco handle logistics and quality checks for used furniture, making buyers more comfortable.

Grand View Research noted how online platforms are facilitating growth by providing convenience and accessibility for used furniture sales.

Also, some brands themselves are embracing resale: for instance, IKEA launched a Buy-Back program in several countries, letting customers return used IKEA furniture for store credit, which IKEA then resells in an “As-Is” section – a move that underscores the circular ethos.

- Experiential retail and pop-ups:

Rather than endless aisles of flat-pack boxes, new retail concepts involve staged, homelike showrooms (sometimes in real homes or apartments). An influencer might open up their chic loft as a by-appointment showroom where everything is for sale (down to the art on the walls).

Or companies set up rotating pop-up shops in trendy neighborhoods, styled as a living space, where curated collections of furniture and decor from various brands are mixed to inspire shoppers. It’s about the experience – people want to discover pieces in an Instagrammable, context-rich environment.

We’ve seen events like “ Vintage Market Days ” (traveling vintage fairs) draw big crowds, and concept stores like Restoration Hardware’s galleries (lavish spaces meant to inspire).

Even boutique hotels, like those with a distinct design theme, often partner to sell the furniture or art you see in the room (so guests can literally “shop the look”).

- Storytelling & authenticity:

New furniture brands are differentiating by telling a story – perhaps sourcing from artisans, or using reclaimed materials. When everything is curated, the background of each piece becomes a selling point.

Brands highlight if a table is made from 100-year-old barn wood or if a particular chair was handcrafted in a family workshop in Italy. This blends with the circular trend when vintage pieces come with a narrative of their previous life.

- Marketplace extensions by big-box chains:

Traditional retailers aren’t sitting idle. Some large chains are launching their own marketplaces to capture third-party and used sales.

For example, Wayfair primarily sells new furniture from many suppliers, but it could also host vintage sellers (in fact, Wayfair has invested in a resale platform called Chairish). Overstock.com acquired and rebranded as Bed Bath & Beyond’s online presence, indicating the blend of old and new inventory.

Anthropologie and Urban Outfitters have sold limited vintage collections alongside new goods. These moves show a recognition that many customers want one-of-a-kind or sustainable options along with new items.

Key Players

On the circular side , startups like Kaiyo and AptDeco (logistics-focused used furniture marketplaces in the US) are growing fast. Kaiyo, for instance, picks up your used furniture, cleans/photographs it, lists it, and delivers to the buyer – making second-hand as easy as buying new.

Chairish and 1stDibs cater to design-savvy shoppers who might otherwise hit antique shops. Facebook Marketplace and eBay remain huge for peer-to-peer furniture swapping, though quality can be hit-or-miss. There’s also Thrifted and vintage stores going online via Instagram and Etsy, expanding their reach.

On the curation side , companies like The Apartment by The Line (a now-closed but influential NYC retail concept that was arranged like a chic apartment) set the stage – now we have others following that model.

Social media influencers (like designers with big followings) curate collections for brands or do affiliate partnerships to sell their style. Additionally, some furniture brands are created with a singular vision – e.g. Burrow (which sells modular sofas, focusing on millennial urbanites) or Floyd (minimalist, easy-assembly pieces) – their product line is tightly curated to a lifestyle, rather than trying to please everyone.

Importantly, trust is a big theme. When buying used or from small curators, customers need assurance: authenticity guarantees, quality checks, easy returns, and even financing options for expensive one-of-a-kind pieces.

Statista noted that trust signals like authenticity checks, AR previews (to see that vintage piece in your space virtually), and instant financing are becoming competitive differentiators.

For example, Chairish offers an augmented reality view for many items, and some marketplaces partner with Affirm or others for financing options at checkout.

In summary, furniture shopping is becoming as personal as fashion . Shoppers mix old and new, seek out that perfect statement piece that nobody else has, and consider resale value and sustainability.

Retailers that curate well give customers the thrill of discovery without the hours of digging. And those that embrace recommerce not only appeal to eco-minded consumers but also open up new revenue streams (taking a cut of second-hand sales, etc.).

As we head further into the 2020s, expect to see more hybrid models – perhaps subscription furniture services (rent a chic setup and swap it out next season), more brand-sanctioned resale (brands helping you resell their product to keep you in the family), and certainly a continued celebration of all things vintage, unique, and story-rich in our living spaces.

Last Thoughts

By keeping an eye on these seven mega trends – from AI design tools to circular retail – you can better understand where the home and living industry is headed.

Whether you're planning a renovation, launching a home décor brand, or just love stylish living, these trends offer both inspiration and actionable insight. To dive deeper into market research techniques that can help you validate these trends, explore our comprehensive guide on using Google Trends for market research.

Homes are becoming smarter, greener, more flexible, and more “us” than ever.

Note: All graphs for search interest in this article were taken from Rising Trends platform and are for searches on Google in the US only.