As we head into 2026, the way people in the US and Europe eat and drink is being shaped by a few mega trends.

Consumers are chasing healthier, more convenient, and more experience-rich options than ever before. From high-protein treats that satisfy without guilt to sustainable foods that help the planet, this year’s top food and beverage trends reflect big shifts in lifestyle and values.

Below we break down seven key trends – and how they’re changing what’s on shelves and menus – along with the market size of each and who’s leading the charge.

Key Takeaways: 2026's Mega Food & Drink Trends at a Glance

| Trend | 2023 Market Size | Projected CAGR | Leading Companies/Products |

|---|---|---|---|

| Protein-Heavy Snacks | ~$9.7 B (global) | ~12% (Mintel est.) | Barebells (protein bars), Quest (protein chips), Premier Protein shakes |

| Gut-Brain Functional Beverages | ~$140 B (global) | ~8% (global) | Poppi & Olipop (prebiotic sodas), Health-Ade’s SunSip, Heywell drinks |

| Female-Centric Nutrition | ~$25 B (global) | ~13% (global) | Lemme gummies (debloat, menopause), MaryRuth’s Organics (prenatal), ARMRA colostrum |

| Instant Convenience Commerce | ~$135 B (global) | ~17% (through 2028) | Gopuff (US delivery), Getir (Europe delivery), Deliveroo Hop |

| Experience-Driven Food & Drink | ~$89 B (global) | ~11.6% (through 2028) | Bucket Listers pop-ups (e.g. Barbie Café ), Dunkin’ Sparkd Energy drinks, PopUp Bagels |

| Sustainable Food Systems | ~$858 B (global) | ~9.1% (global) | Too Good To Go (food-waste app), Just Salad (reusable bowls, carbon labels), Beyond Meat |

(CAGR = compound annual growth rate)

To dive deeper into the methodology behind identifying these trends, check out our comprehensive guide on Google Trends for market research which shows how we analyzed search data to spot these emerging patterns.

For entrepreneurs looking to capitalize on these growth opportunities, our guide on how to use Google Trends to find profitable niches provides actionable strategies for identifying high-potential food and beverage markets.

1. Protein-Heavy Snacks – Guilt-Free, Protein-Packed Treats

Snacks are bulking up on protein. Consumers want the grab-and-go indulgence of a cookie, chips, or candy – but without the guilt from carbs and sugar.

This has fueled a wave of “protein-heavy” snacks that transform traditional treats into nutrient-dense options.

Think crunchy protein chips instead of potato chips, creamy protein-fortified shakes that taste like dessert, or even candy-like protein bars.

As one report put it, people seek “dessert-like convenience without macro guilt,” driving growth in bars, chips, shakes and even high-protein ice creams.

The global high-protein snack segment was about $9.7 billion in 2023 , with Mintel estimating ~ 12% annual growth as fitness enthusiasts, dieters, and even users of new weight-loss drugs look for filling, low-sugar options.

Why It Matters Now

High-protein snacks align with several 2025 consumer priorities: managing weight, building or preserving muscle, and curbing sugar intake.

Notably, the rise of GLP-1 appetite-suppressant medications (like Ozempic) for weight loss is changing eating habits – people eat less overall, so they favor protein-rich, low-sugar snacks to get nutrients in smaller portions.

Industry analysts predict these “GLP-1 friendly” foods will keep growing as more people adopt such medications .

In short, protein-heavy snacks hit the sweet spot (literally) of satiety and taste , letting health-conscious consumers treat themselves and hit their macros at the same time. This protein revolution extends beyond food – it's reshaping hydration and sports nutrition as well. See our analysis of fitness trends for 2026 for the full picture on electrolytes, protein water, and workout recovery.

Examples Of Sub-Trends/Products

Protein-packed versions of familiar snacks are popping up everywhere.

We see Quest Nutrition turning out low-carb Protein Chips with 19g+ protein per bag, and Legendary Foods selling Popped Protein Chips in ranch and nacho flavors.

Even sweet treats are getting protein makeovers – Barebells (a Swedish brand now in the US/EU) makes protein bars that taste like candy bars but deliver 15–20g protein and very little sugar.

Premier Protein offers shakes in indulgent flavors (Cookies & Cream, Caramel) with 30g of protein.

There are also niche hits like SimplyFuel ’s protein peanut butter balls and high-protein ice creams (“ Protein Pints ”).

This trend spans almost every snack format imaginable.

Key Players

Many of the leading brands in this trend started in sports nutrition and are now going mainstream.

For example, Barebells (known for its tasty protein bars and drinks) and Quest Nutrition (bars and chips) are expanding from gyms into convenience stores.

Premier Protein – whose shakes and powders turn desserts into protein drinks – is a top seller in U.S. retail.

Even big food companies are jumping in: Conagra and Nestlé have launched high-protein frozen snacks and mini meals marketed as “high-protein, low-sugar” to appeal to this demographic.

It’s clear that protein is no longer just for bodybuilders – it’s a daily must-have for the average snacker.

2. Gut-Brain Functional Beverages – Drinks for Digestion and Mood

A new generation of drinks is blurring the line between beverages and supplements, targeting both gut health and brain health together.

These functional beverages are often sodas, teas, or coffees boosted with ingredients like probiotics (for digestion) , prebiotic fiber , adaptogenic herbs (for stress and mood), and extra protein – all while cutting down on sugar.

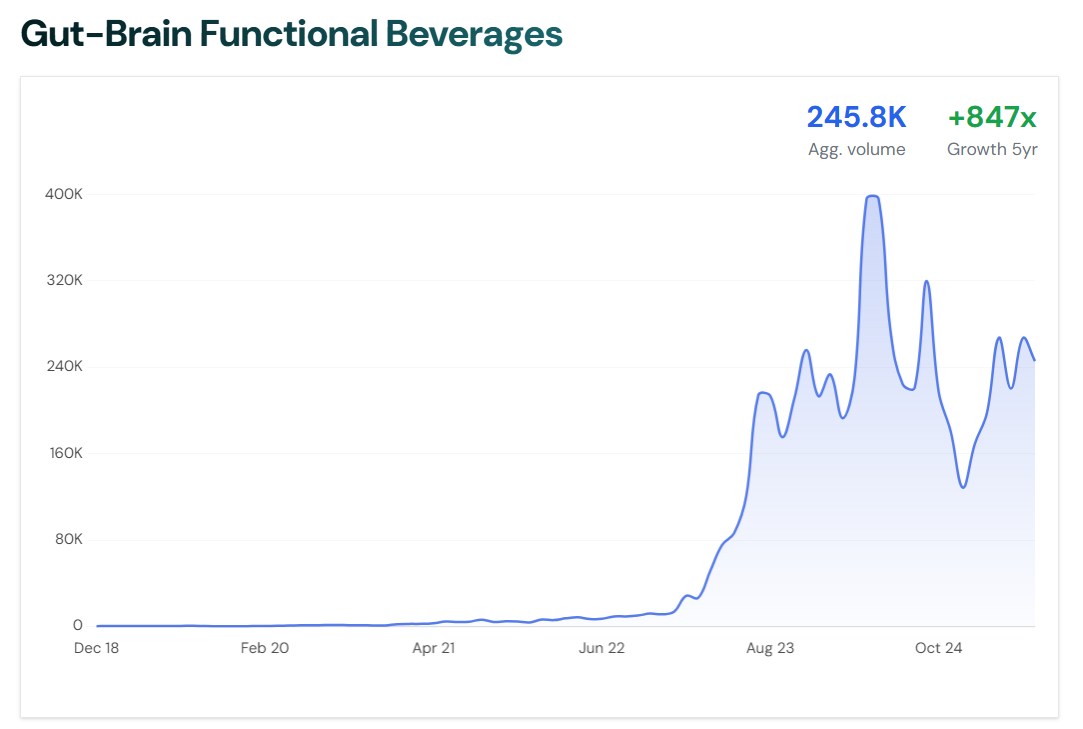

In 2023 the functional beverage market hit a whopping $140 billion globally , and it’s forecast to grow around 8% per year .

Consumers are embracing drinks that do more than quench thirst – they promise to improve your microbiome or give you calm focus, essentially turning your soda or cold brew into a wellness drink.

Why It Matters Now

The buzzphrase is the “gut-brain axis.”

Research in the past few years has shown our digestive health is linked to mood and cognition, so it was only a matter of time before products addressed both.

Coming out of the pandemic, many people in the US and Europe are prioritizing mental well-being and digestive health.

Functional beverages offer a convenient, enjoyable way to support those goals – you can swap your regular cola or latte for one that also delivers probiotics or stress-relieving botanicals.

Additionally, with sugar scrutinized, these drinks use botanicals and fruit fiber to add flavor and function in place of heaps of sugar.

All these factors make 2025 the year of the “smarter” drink – beverages that align with the trend toward self-care and healthier indulgence.

Examples Of Sub-Trends/Products

A few standout categories within this trend include prebiotic sodas – fizzy drinks with plant fiber for your gut.

Brands like Poppi and OLIPOP are leading the charge here, offering flavors reminiscent of classic soda (cola, root beer, etc.) but with a fraction of the sugar and added prebiotics.

There are also adaptogen-infused drinks like heywell ’s sparkling waters, which include herbs (ashwagandha, ginseng, etc.) to help with focus or relaxation.

Even the coffee and tea category is evolving: for example, mushroom coffees (like RYZE coffee) blend traditional coffee with lion’s mane or reishi mushrooms to support focus and immunity.

And “protein lattes” or protein matcha lattes add a scoop of protein so your morning drink is more filling.

In short, nearly every kind of beverage – from sodas to energy drinks to coffees – now has a functional twist available.

Beyond these established brands, keep an eye on the Feel Free Tonic trend – a kratom-kava functional beverage that's rapidly gaining traction as consumers seek alcohol-free relaxation options with natural calming effects.

Leading Companies/Products Benefiting

A number of innovative beverage startups have surged ahead in this space.

Poppi (Texas-based) and OLIPOP (California-based) are two popular prebiotic soda brands now stocked in major supermarkets – they’ve made waves by turning apple cider vinegar and plant fibers into tasty drinks.

Kombucha pioneer Health-Ade even launched a new prebiotic soda line called SunSip to capitalize on the soda-with-benefits craze .

On the more caffeinated side, companies like RYZE Superfoods (mushroom coffee) and Four Sigmatic are bringing functional fungi to coffee lovers.

And for adaptogenic beverages, heywell (U.S.) and UK’s No.1 Botanicals are examples blending botanicals for stress relief in ready-to-drink form.

Even big beverage players are noticing the trend – PepsiCo and Coca-Cola have invested in healthier drink brands and are formulating products with fiber and probiotics.

With consumers willing to pay a premium for drinks that help them “drink to their health,” this sector is only going up.

3. Female-Centric Functional Nutrition – Wellness Tailored for Women

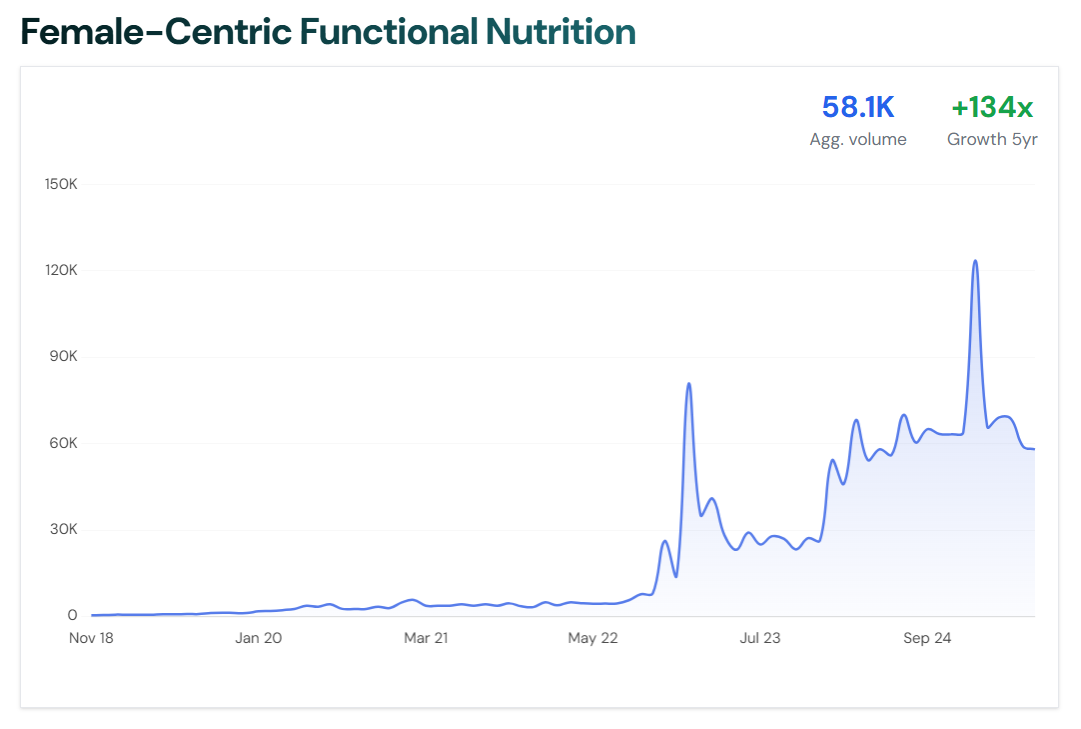

There’s a boom in nutrition products designed specifically for women’s health – from supplements that ease menopause symptoms to snacks for prenatal nutrition.

Rather than one-size-fits-all vitamins, brands are crafting formulas for issues like PCOS , menopause , the gut-skin axis (think acne and skin health), fertility, and more.

For example, you can now find gummies that claim to reduce bloating during PMS, collagen powders for postpartum recovery, and even protein snacks aligned to menstrual cycle phases.

This female-focused nutrition market was valued around $25 billion in 2023 , with strong ~ 13% CAGR growth as women (especially Millennials and Gen Z) invest in wellness solutions tailored to their life stage and hormonal needs.

Why It Matters Now

Women’s health needs have often been underserved or generalized in mainstream nutrition, but 2025 is seeing that change fast.

Greater openness about topics like menopause and PCOS, fueled by social media communities and celebrity voices, has created demand for products that speak to these issues.

For instance, more women are talking about the gut-skin connection (how diet affects acne) or the challenges of perimenopause, and they’re seeking targeted nutrients to help. At the same time, the wellness market recognizes that women control a lot of household purchasing and are willing to spend on self-care.

The result is a flood of innovation in female-centric supplements and functional foods – often with branding that’s friendly, Instagrammable, and science-backed.

In the US and Europe, there’s also a trend of women taking a proactive approach to health at all ages, rather than waiting for a doctor’s recommendation. This has made products for hormonal balance, reproductive health, and healthy aging extremely popular now.

Examples Of Sub-Trends/Products

We’re seeing a variety of products addressing specific women’s health goals.

Some examples include: debloating supplements like Lemme Debloat gummies (a probiotic gummy by Kourtney Kardashian’s brand Lemme , aimed at reducing bloating and aiding digestion), and separate menopause relief gummies such as Flourish or O Positiv’s MENO formula, which use ingredients like black cohosh and ashwagandha to ease hot flashes and mood swings.

There’s ARMRA Colostrum powder , a supplement using bovine colostrum marketed for immune and gut health (with a loyal following among women who credit it for better skin and energy).

For younger women and moms, brands like MaryRuth’s Organics have prenatal and postnatal multivitamin gummies , and TruHeight makes nutrient gummies to support kids’ growth (often bought by mothers concerned about picky eaters).

Even beauty supplement lines are part of this trend – for example, Hers (the women's side of Hims & Hers Health) offers Hair Vitamins with biotin to target hair thinning in women. For a comprehensive look at the broader haircare market including trending ingredients and treatments, explore our data-backed analysis of top haircare trends in 2026.

In short, if there’s a women’s wellness concern, there’s likely a snack or supplement formulated for it in 2025.

Leading Companies/Products Benefiting

A mix of newcomer brands and established players are driving this trend.

On the celebrity front, Lemme (founded by Kourtney Kardashian) has gained traction with its line of chic gummies like Lemme Debloat and Lemme Menopause, signaling mainstream appeal for things like PMS support.

Traditional vitamin companies are also refocusing on women – for example, Vitabiotics in the UK has expanded its Wellwoman range, and MaryRuth’s Organics (US) has become a go-to for women seeking vegan, clean-ingredient vitamins (their Liquid Prenatal Multivitamin is especially popular).

Specialty startups like ARMRA (for colostrum) and Clearstem (which makes a hormonal acne supplement) show how niche needs are being met with direct-to-consumer savvy.

Even big supplement players are acquiring or developing women-centric lines as they see the growth potential.

Behind that 13% annual growth is a simple truth: women are tired of being an afterthought in nutrition, and companies that cater to them are being rewarded.

This focus on targeted nutrition aligns with broader wellness trends, including the growing sleep hygiene trend which emphasizes how lifestyle factors like diet and rest contribute to overall health optimization. For a deep dive into the full supplement landscape – from magnesium forms to adaptogens to gut health probiotics – see our comprehensive supplement trends report for 2026.

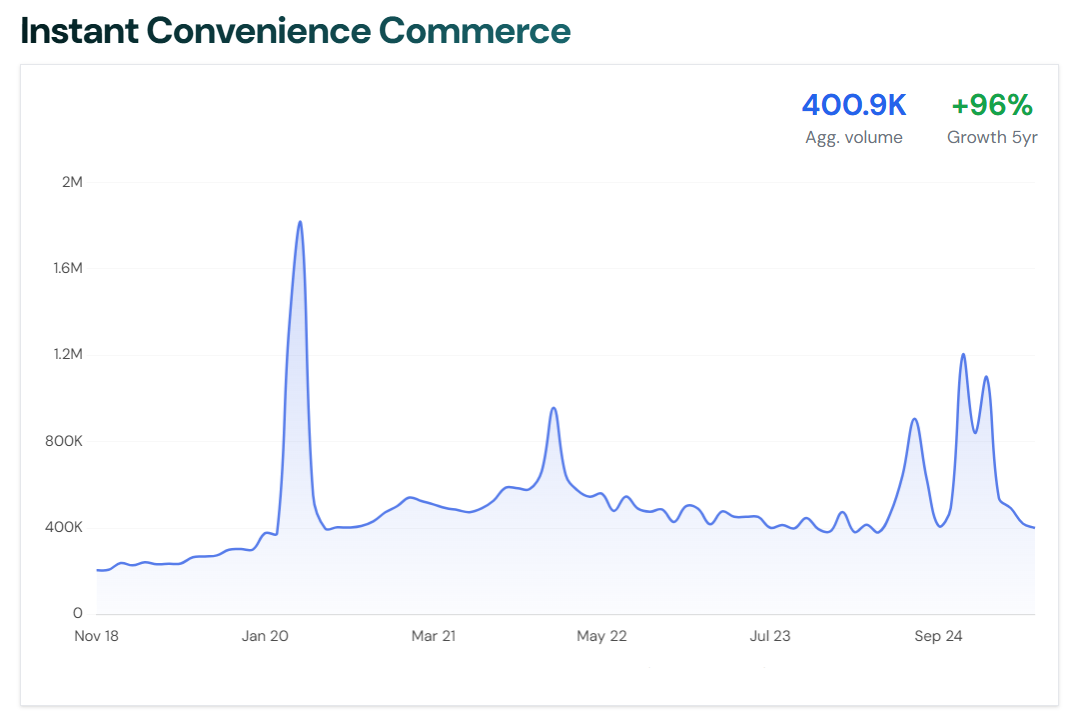

4. Instant Convenience Commerce – Ultrafast Grocery Delivery

The phrase “instant commerce” (or quick-commerce) refers to super-fast delivery of groceries, meals, and daily essentials – typically in 15–30 minutes from order to your door.

In 2025, this has evolved from a pandemic-era novelty into an expectation in many urban areas of the US and Europe. Dedicated apps and services use networks of dark stores (mini warehouses) and courier fleets to fulfill orders blindingly fast.

Globally, the quick-commerce market reached about $135 billion in 2023 and is projected to grow around 17% a year through 2028 .

This growth is fueled by consumers’ craving for convenience, ever-improving mobile apps, and heavy venture capital investment in delivery startups over the past few years.

Why It Matters Now

Consumer expectations have been permanently altered – people now expect to get that missing ingredient or last-minute dinner delivered almost immediately.

During the COVID lockdowns, many got a taste of 10-minute grocery deliveries, and those habits stuck. In cities from New York to London to Berlin, competition to deliver fastest has been fierce, leading to better coverage and lower fees for customers.

In 2025, even as the delivery market shakes out (with some startups folding or consolidating), the ultrafast delivery model has proven its appeal – especially for time-crunched urbanites or anyone who simply doesn’t want to run to the store.

Additionally, big retail players have jumped in: for example, Walmart in the US and Aldi in Europe have each partnered with courier services or built their own systems to offer under-an-hour delivery.

The bottom line is that “waiting two days” feels outdated when many items can come to your doorstep in minutes. Instant convenience commerce is reshaping grocery retail and consumer expectations around speed.

How It Works (Sub-Trends)

These services typically rely on apps where customers order from a selection of products stored in a local fulfillment center.

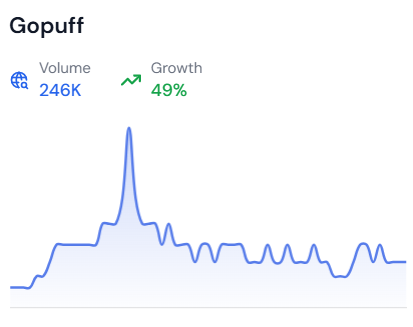

Companies like Gopuff pioneered this in the US – they stock snacks, drinks, household items in small warehouses across cities, employing drivers to deliver ASAP.

In Europe, players like Getir (originally from Turkey) and Flink (Germany) expanded rapidly, promising groceries at your door in 10 minutes.

Food delivery platforms are also in the game: Deliveroo launched Deliveroo Hop for instant groceries in the UK, and Uber Eats and DoorDash added convenience store and supermarket partners for quick delivery.

Under the hood, there’s a lot of tech – inventory algorithms predict what locals will need, and courier routing software optimizes drop-offs.

The “dark store” concept (closed to public micro-warehouses) is key; by storing only the most-ordered items hyper-locally, these services cut delivery times dramatically.

The sub-trend even extends to automat-style pickups and smart vending machines, but courier delivery is the main model.

Leading Companies Benefiting

The landscape is a mix of specialized startups and retail giants.

In the US, Gopuff has become a leader, operating in many cities with its own products and driver network.

Another notable name is Instacart , which, while not 15-minutes-fast everywhere, is pushing into faster deliveries and partnering with chains for virtual convenience stores.

In Europe, Getir made headlines by expanding into multiple countries (though it recently refocused operations) and acquiring rivals like Gorillas .

Flink and Gorillas in Germany (now under Getir) built strong brands around the 10-minute grocery idea.

Traditional grocers are in the mix too: Tesco (UK) and Carrefour (France) have trialed instant delivery via partnerships. And as mentioned, Walmart offers Express Delivery in the US (often under 30 minutes) leveraging its store network.

All these players are vying for a share of that fast-growing market, though the race hasn’t been easy – profitability remains challenging.

Still, with consumers showing they’ll use the service ( over 50 million Americans tried some form of instant grocery delivery in 2024 ), the model is here to stay and integrate into everyday life.

5. Experience-Driven Food & Drink – Eating as Entertainment

Dining out and even grabbing a drink have become immersive experiences in 2025.

We’re seeing themed pop-up restaurants, hybrid bar-meets-entertainment venues, and “eatertainment” concepts that turn a meal into an event. Even packaged drinks are getting in on the fun – with quirky new flavors or nostalgia-driven products (e.g. a canned martini ready-to-drink cocktail).

The idea is that consumers, especially Gen Z and Millennials, crave novelty, interactivity, and shareable moments from their food and drink.

This experiential sector – spanning things like themed cafés, pop-up bars, food festivals, and ready-to-drink craft cocktails – was valued around $89 billion in 2023 and is projected to grow about 11.6% yearly through 2028 .

In short, food is the new theater , whether it’s a limited-time menu collab or a cafe with a built-in roller rink.

Why It Matters Now

After periods of lockdowns and isolation, consumers are eager to make dining social and exciting again.

In the US and Europe alike, there’s huge demand for experiences that can be documented on Instagram or TikTok – the “did it for the Gram” effect is real in driving foot traffic.

Limited-time or pop-up concepts also tap into FOMO (fear of missing out), motivating people to go spend on a unique experience now before it’s gone.

From a business perspective, creating an experience-driven offering can allow higher pricing and free marketing via social media sharing.

Younger consumers in particular value experiences over material things, so they’re directing their spending toward novel food and drink outings.

Additionally, the blending of digital and physical is a trend: for example, live shopping apps in Asia have turned buying food into interactive entertainment, and that idea is spreading west.

All these factors make experience-driven F&B a powerful trend shaping how brands and restaurants engage their audience in 2025. For an in-depth look at how restaurants specifically are transforming the dining experience, see our comprehensive restaurant trends for 2026.

Examples Of Sub-Trends/Products

There’s a wide spectrum here. On the restaurant side, themed pop-ups are huge – like the Malibu Barbie Café pop-up that toured cities (complete with a roller rink and 70s Malibu decor), or the “Golden Girls” kitchen pop-up in Los Angeles serving nostalgia with a side of cheesecake.

Fusion concepts are also popular, e.g. a sushi bar that turns into a speakeasy at night, blending cuisines and atmospheres (sometimes called “ third-wave BBQ ” or other mashups).

Another aspect is food as spectacle: some new dessert bars or tea shops incorporate live prep in front of customers, almost like a performance.

In beverages, RTD (ready-to-drink) craft cocktails and unusual flavor combos are catching attention – for instance, a startup might sell a canned espresso martini that lets you have a high-end cocktail experience at home.

Even big brands are trying whimsical products: Coffee Mate released a limited “Dirty Soda” flavored creamer ( inspired by the TikTok-favorite dirty soda trend ), and Dunkin’ launched Spark’d Energy drinks in its stores that mix coffee culture with energy drink vibes.

Overall, anything that stands out as novel, limited, or interactive – from an energy drink named after a viral dance to a pop-up bagel shop that operates only on weekends – falls under this trend of food and drink as an experience.

Leading Companies/Products Benefiting

Many players here aren’t traditional big companies but rather creative entrepreneurs and collabs.

Bucket Listers , for example, is a company that partners with brands to create buzzworthy pop-up experiences (they were behind the Malibu Barbie Café in San Diego and other cities).

Their events draw huge crowds and lots of social media buzz, benefiting both the event organizers and the brands involved (Mattel, in Barbie’s case).

In hospitality, groups like IHG’s Hotel Indigo or Marriott’s W Hotels have done immersive dining events, blending lodging with local food pop-ups.

On the product side, established beverage companies are releasing playful extensions – e.g. Dunkin’ (the coffee chain) rolled out those Spark’d Energy drinks in 2024 as a fun in-store option to draw younger customers.

Smaller craft brands like Tip Top Proper Cocktails (canned classics) or Somnium Wine’s collaborations are also carving a niche.

And we can’t forget social media-driven brands like PopUp Bagels – a Connecticut-origin bagel popup that became so popular it won awards and is expanding as a quasi-subscription bagel experience.

Even after the initial hype of an experience fades, the best ones convert into lasting brands or at least annual traditions (for example, an annual themed food festival).

With social platforms amplifying every cool new food experience, the companies that create shareable moments are the ones winning in this space.

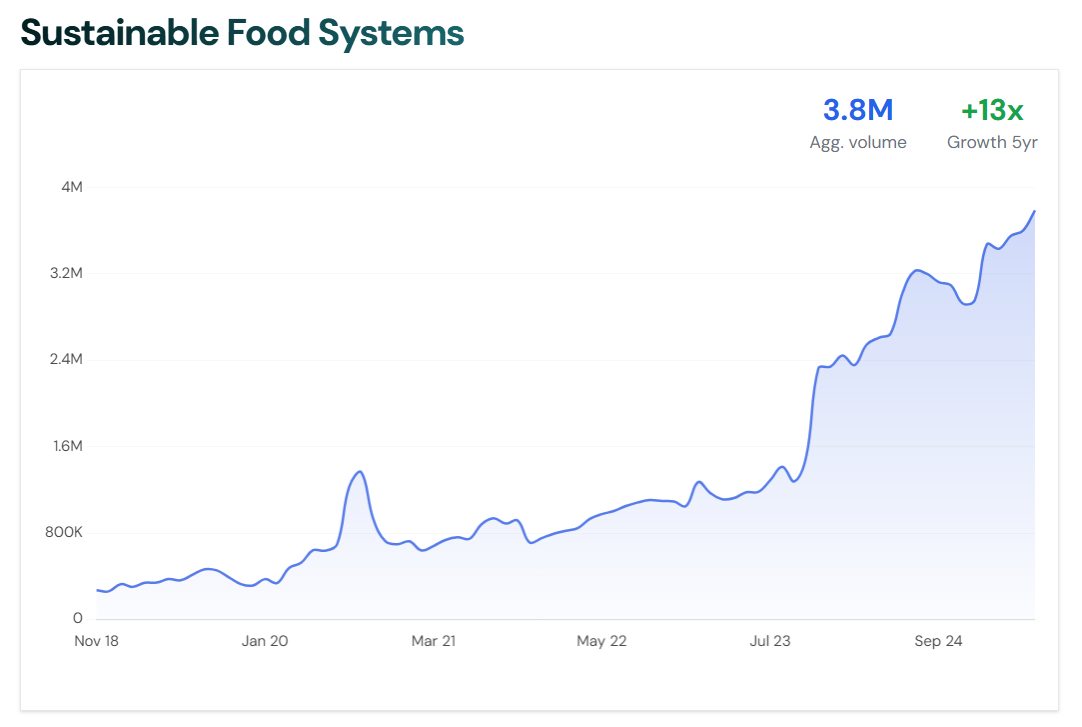

6. Sustainable Food Systems – Eating with a Climate Conscience

Sustainability has moved from a niche concern to a mainstream driver in the food industry. Consumers (and producers) are rethinking how food is grown, processed, packaged, and wasted with an eye on environmental impact.

This mega trend spans organic and regenerative agriculture , plant-based alternatives , low-waste grocery models , and more.

In 2023 the broad sustainable food market – which includes organic foods, plant-based products, and regenerative farming outputs – reached about $858 billion globally , with an expected growth rate of ~ 9.1% CAGR as these practices scale up.

Essentially, sustainable food systems aim to provide nutrition with a lighter carbon footprint and more ethical supply chains, from farm to fork.

Why It Matters Now

Climate change and environmental concerns are top of mind for many, especially younger consumers in Europe and North America who feel a sense of urgency to “vote with their wallet.”

In practice, that means choosing foods that are labeled organic, locally grown, cruelty-free, or climate-friendly, even if they cost a bit more.

Governments and investors are also pushing this trend – for example, the EU’s Green Deal and Farm to Fork strategy encourage sustainable ag, and the US has incentivized organic and urban farming in recent bills.

Technological advances have made some sustainable options more viable too: e.g. vertical farming tech can grow produce in urban warehouses year-round with less water; precision fermentation can create dairy alternatives without cows.

All these developments are converging in 2025 to make sustainable foods more accessible and varied.

There’s also a cultural shift: eating sustainably is seen as part of a modern, responsible lifestyle, much like recycling or driving an EV.

People want transparency about where their food comes from and its environmental impact – and they are rewarding brands that align with their values.

Examples Of Sub-Trends/Products

There are many, including: Regenerative agriculture products – some meat and dairy brands now advertise that their farms restore soil and sequester carbon (e.g., beef from regenerative ranches or “carbon-neutral” milk).

Plant-based and alternative proteins remain a huge sub-trend – beyond the well-known Beyond Burgers and Impossible Foods , we now have things like algae snacks (seaweed chips, spirulina smoothies) and mycoprotein meats ( Quorn and new startups making mushroom-based chicken alternatives).

Even lab-grown (cultivated) meat is on the cusp of wider availability; a few restaurants in the US are serving cell-based chicken as a trial.

On the retail side, low-waste shopping is emerging: apps like Too Good To Go connect consumers with surplus bakery and restaurant food at discount prices to prevent waste, while some grocery stores offer bulk/refill stations to cut packaging.

Vertical farming and local urban farming also play a role – brands like Little Leaf Farms in New England grow salad greens hydroponically year-round, supplying local stores and cutting down on transport emissions.

Similarly, in Europe, you see more farmers’ market delivery startups and “online farmers market” platforms connecting consumers directly to local producers.

Another interesting sub-trend is upcycled foods – using ingredients that would’ve been waste (e.g. making beer from surplus bread, or snack bars from fruit pulp).

Overall, the sustainable food systems trend encompasses anything that makes the food chain greener and more ethical.

Sustainability in food choices often extends to other lifestyle decisions. For insights into parallel trends in home design, explore our analysis of top home improvement and design trends which reveal how consumers are creating more eco-conscious living spaces.

Leading Companies/Products Benefiting

A mix of mission-driven startups and forward-thinking big companies are leading here.

In plant-based, Beyond Meat and Impossible Foods are household names continuing to refine their products (e.g. Beyond’s latest vegan burger uses less saturated fat and more sustainable pea protein).

Traditional giants like Danone and Unilever have also embraced sustainability – Danone North America has converted acreage to regenerative farming for its milk supply and owns pioneering plant-based brands (e.g. Silk, Alpro).

In retail and service, Too Good To Go (originated in Denmark) is now operating in many U.S. and European cities, saving millions of meals from landfill by cleverly reselling restaurant leftovers.

Fast-casual chain Just Salad is championing reusables (they offer a reusable bowl program) and carbon-labeled menus to inform diners of a meal’s footprint .

Supermarkets like Whole Foods and Planet Organic have built their brand around sustainable sourcing and continue to grow.

We also see collaboration: for instance, tech companies providing blockchain tracking so you can scan a coffee and see it was grown by a farmer who got fair pay and used sustainable methods.

As climate concerns intensify, businesses that can demonstrate genuine impact – whether it’s vertical farms like Plenty cutting water use by 90% or regenerative meat companies like White Oak Pastures sequestering carbon in soil – are gaining customer trust.

The momentum behind sustainable food is strong, and it’s transforming everything from farming practices to how we shop and eat, making sustainability a defining pillar of the food industry’s future.

Summary

In summary, 2025’s food and beverage landscape in the US and Europe is being reshaped by these mega trends. Each reflects a common theme: consumers are seeking* healthier, smarter, and more meaningful choices *in what they eat and drink.

Whether it’s a protein bar that supports your gym goals, a soda that heals your gut, a supplement tailored to your life stage, groceries delivered in a flash, a meal that’s an Instagram-worthy event, or a burger that didn’t harm the planet – innovation is catering to these desires.

Companies that understand and embrace these trends (with authentic products and credible benefits) are thriving.

For the consumer, it means more options than ever to align food with personal values and needs. The plate (and glass) of 2025 is more than just fuel; it’s a statement of who we are and the future we want to see in the world.