Rent is getting harder to afford. Average U.S. rent has climbed 25 % since 2020, while wage growth lags. A growing group of startups promises relief through Flex Rent.

Why now

- Inflation and record home prices keep renters locked in leases.

- More than half of U.S. renters spend over 30 % of income on housing, according to the latest Census data.

- Gig-economy work has made monthly cash flow volatile. Splitting rent across paychecks fits new income rhythms.

How it works

- A renter links a debit card or bank account.

- The platform sends the full rent to the landlord on the due date.

- The tenant repays in two to four smaller installments across the month.

- Fees range from $15 per month to 1–3 % of rent.

Some apps report on-time splits to credit bureaus, turning rent into a credit-building tool.

Who is doing it

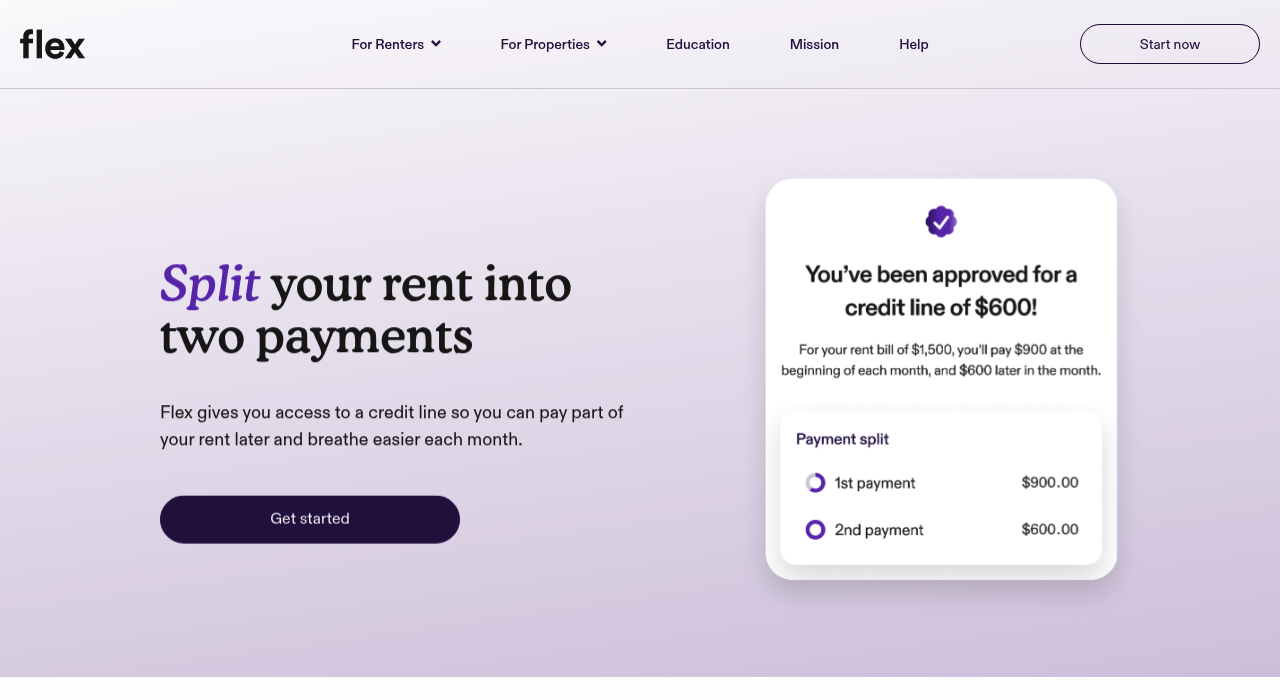

• Flex, launched in 2019, serves 200,000+ units and raised $50 M Series B led by Tiger Global, per TechCrunch.

• Livble enables U.S. renters to split monthly rent into up to four installments and just closed an acquisition by RealPage (integrating the service into its property management platform), reports The Verge.

• Property managers like Greystar now embed flexible payments in resident portals through API deals with prop-tech firms.

Market size

The U.S. has 44 million renter households. If even 5 % adopt flexible rent at an average $10 fee, annual revenue tops $264 million. Expansion to Canada, the U.K., and Australia adds millions more potential users.

Benefits for each side

Landlords

• Receive rent in full and on time.

• Lower delinquency rates can cut collection costs by up to 30 %, per a 2024 NMHC survey.

Renters

• Match payments to bi-weekly or weekly pay cycles.

• Avoid payday loans and late fees that often exceed flexible-rent charges.

• Build credit when platforms report payments.

Risks and critiques

- Convenience fees could add financial strain for the poorest renters.

- Some see the model as a payday-loan cousin if fees creep upward.

- Platforms carry underwriting risk; missed installments mean they float the loss.

- Regulatory attention is likely. The CFPB has already asked for comment on “earned-wage access” products, a related category.

What’s next

• Bundling. Apps are adding utilities, renters insurance, and savings tools to raise revenue per user.

• Employer partnerships. Companies may offer flexible rent as a financial-wellness perk.

• AI underwriting. Real-time income and spending data could replace credit scores when approving renters.

• Policy shifts. If cities adopt “rent-smoothing” subsidies, public funds might flow through these platforms.

Paying rent once a month is a relic of the paper-check era. Flexible schedules align housing costs with modern cash flow. As fees fall and trust grows, expect Flex Rent to move from edge case to default option within the decade.